DIRECTORS’ REPORT

88 Independence Group NL

Directors' report

30 June 2015

Remuneration report (continued)

(h) Additional statutory information (continued)

(iii) Reconciliation of ordinary shares and share rights shares held by KMP (continued)

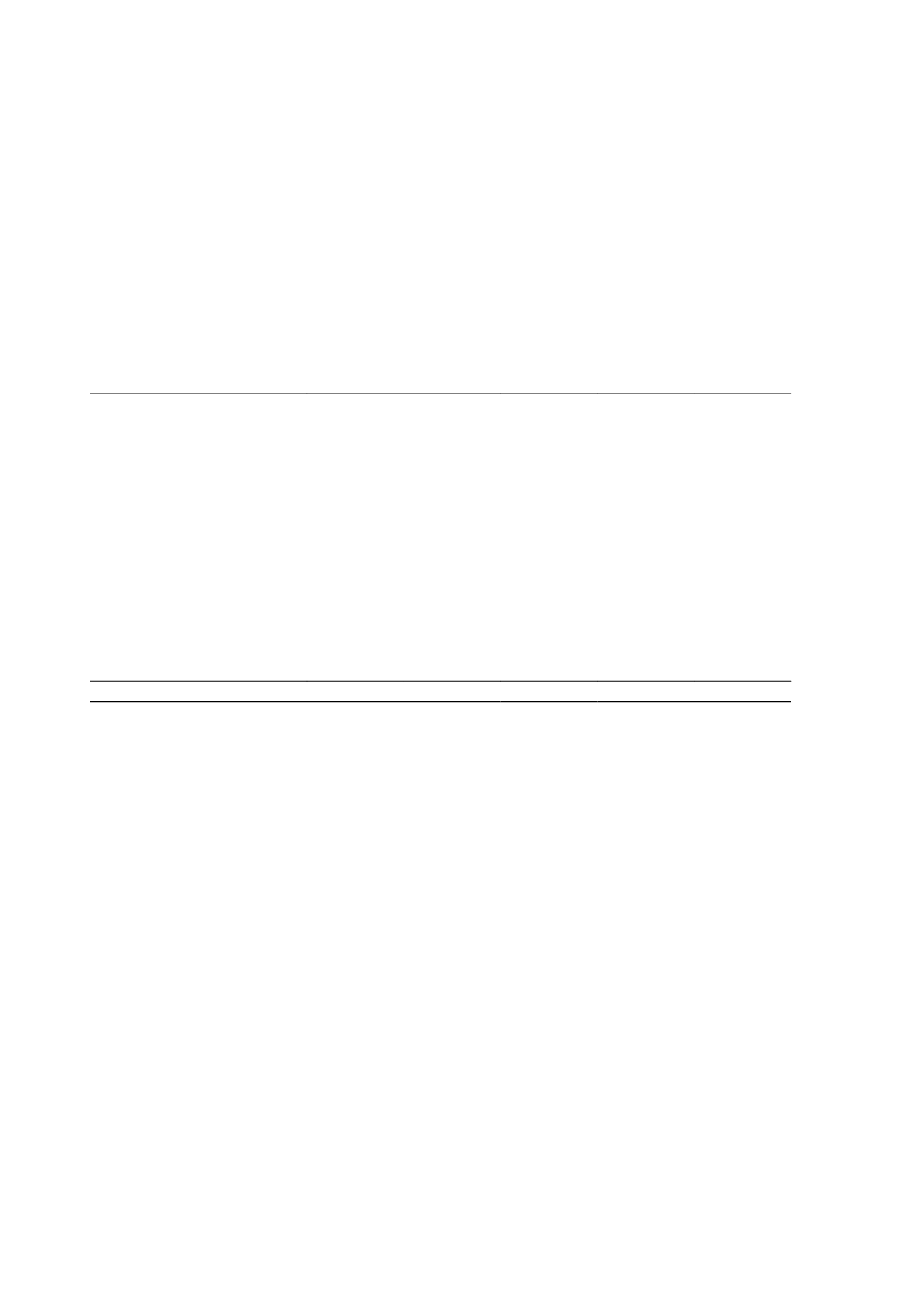

Share rights in the Company

2015

Name

Balance at the

start of the

year

Granted

during the

year

Vested as

shares during

the year

Lapsed during

the year

Other changes

during the

year

Balance at the

end of the

year

Directors of

Independence

Group NL

Peter Bradford

-

175,365

-

-

-

175,365

SPACE

Other key

management

personnel

Keith Ashby

-

-

-

-

-

-

Matt Dusci

-

50,154

-

-

-

50,154

Andrew Eddowes

1

87,218

-

-

-

(87,218)

-

Brett Hartmann

197,063

58,513

(43,738)

(14,580)

-

197,258

Rodney Jacobs

1

172,394

-

-

-

(172,394)

-

Tim Kennedy

1

153,265

-

-

-

(153,265)

-

Sam Retallack

25,003

10,473

(7,443)

(1,213)

-

26,820

Scott Steinkrug

182,839

50,154

(40,579)

(13,527)

-

178,887

Tony Walsh

66,596

50,154

-

-

-

116,750

Total

884,378

394,813

(91,760)

(29,320)

(412,877)

745,234

1. Shareholdings are reversed to show a zero balance at 30 June 2015 on resignation as a director or ceasing to be a KMP.

The share rights relate to the KMP’s participation in the PRP. The share rights represent the maximum number of share

rights that the KMP are entitled to. They are subject to certain performance conditions being met, including the ongoing

employment of the KMP at the end of the vesting period.

(iv) Other transactions with key management personnel

During the current financial year, there were no other transactions with key management personnel or their related

parties.

(v) Reliance on external remuneration consultants

During the current financial year, the Board authorised the engagement of Gerard Daniels to prepare a report examining

the competitiveness of remuneration for directors and officers employed by the Company in the context of a group of

peer companies. An amount of $12,500 was paid for the report.

The Company also utilised data provided by Aon Hewitt McDonald and AusREM regarding salaries and benefits across

the organisation, with amounts paid for the data of $4,750 and $4,500 respectively.

The Board is satisfied that the recommendations provided in the various reports were made free from undue influence

from any members of the key management personnel.

(vi) Voting of shareholders at last year's annual general meeting

Independence Group NL received more than 99% of “yes” votes on its remuneration report for the 2014 financial year.

The Company did not receive any specific feedback at the AGM or throughout the year on its remuneration practices.

Shares under option

At the reporting date, there were no unissued ordinary shares under options, nor were there any ordinary shares issued

during the year ended 30 June 2015 on the exercise of options.

Independence Group NL

23