12 Independence Group NL

RESULT FOR THE YEAR ENDED 30 JUNE 2015

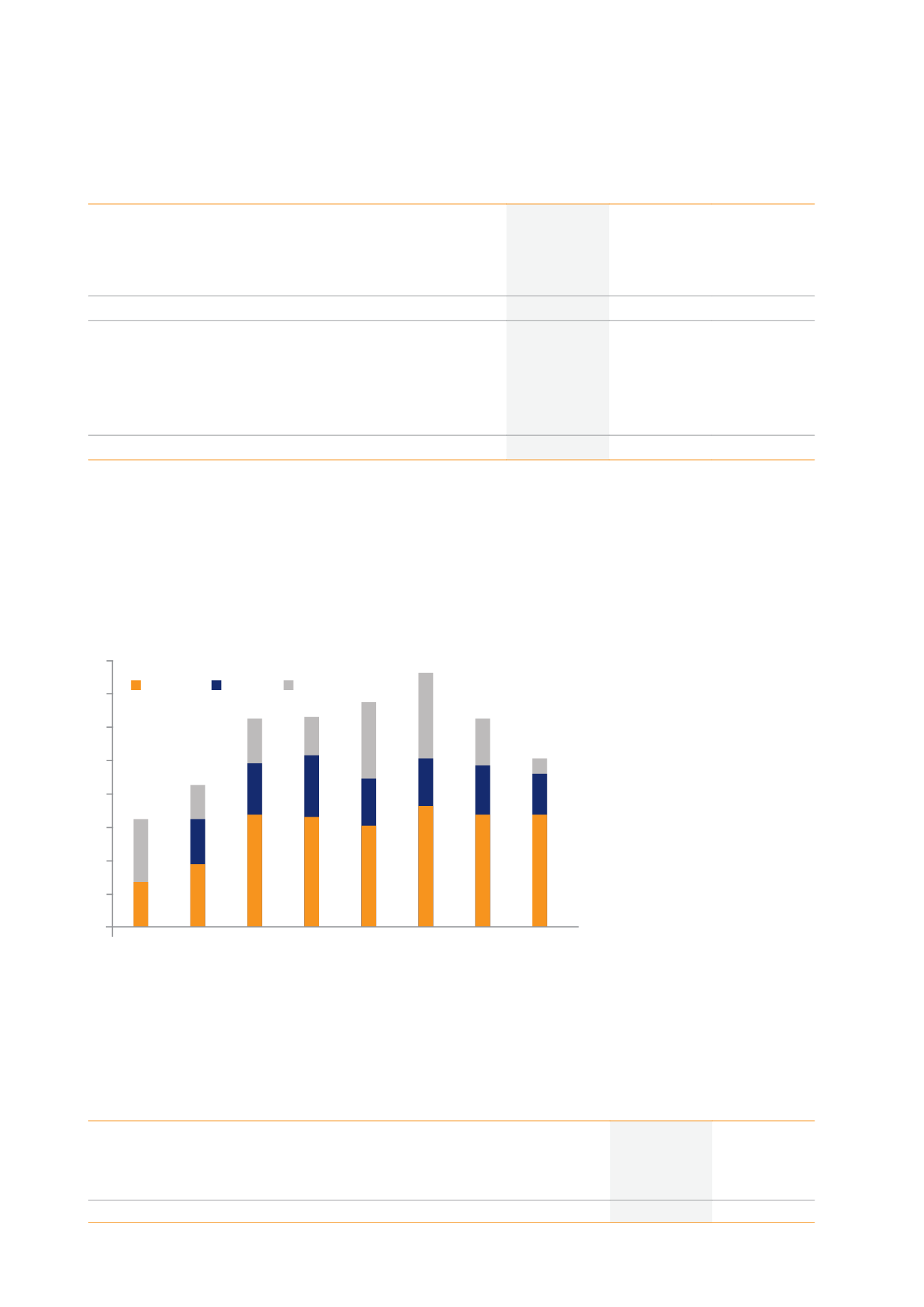

Underlying EBITDA ($’M)

Tropicana

Long

Jaguar

Q1FY14 Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15

80

70

60

50

40

30

20

10

0

Financial Summary

Highlights

FY2015

$millions

FY2014

$millions

Change

%

Total revenue

1

499

399

25%

Underlying EBITDA

2

213

148

44%

Profit after tax

77

49

58%

Net cash flow from operating activities

202

129

57%

Free cash flow

3

116

30

283%

Total assets

820

781

5%

Cash

121

57

113%

Marketables securities

16

1

1,716%

Total liabilities

155

171

(10)%

Shareholders’ equity

666

610

9%

Net tangible assets per share ($ per share)

$2.84

$2.62

8%

1

Includes other income of $3.3M (FY2014: $0.96M)

2

See Glossary of Terms for a definition of Underlying EBITDA.

3

Free cash flow comprises net cash flow from operating activities and net cash flow from investing activities.

Full details on IGO’s financial results for FY2015 and IGO’s financial position at 30 June 2015 are set out the audited financial

statements and notes included in section 9 of this Annual Report.

Underlying EBITDA

(1)

By Mining Operation On A Quarter By Quarter Basis Since 1 July 2013

(1) See Glossary of Terms for a definition of Underlying EBITDA.

Dividends

During FY2015, IGO adopted a dividend policy which states that, subject to the satisfaction of the test set out in section 254T

of the

Corporations Act 2001

, IGO intends to maintain a minimum dividend payment payout ratio of 30% of net profit after tax,

rounded to the nearest whole cent.

Dividends paid to members during the financial year were as follows:

2015

$’000

2014

$’000

Final ordinary dividend for the year ended 30 June 2014 of 5 cents (2013: 1 cent)

per fully paid share

11,713

2,333

Interim ordinary dividend for the year ended 30 June 2015 of 6 cents (2014: 3 cents)

per fully paid share

14,055

7,000

25,768

9,333

On 22 September 2015, IGO announced a fully franked final dividend of 2.5 cents per share (FY2014: 5.0 cents).