NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

154 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

36 Deed of cross guarantee

Independence Group NL, Independence Long Pty Ltd and Independence Jaguar Limited are parties to a deed of cross

guarantee under which each company guarantees the debts of the others. By entering into the deed, the wholly-owned

entities have been relieved from the requirement to prepare a financial report and directors' report under Class Order

98/1418 (as amended) issued by the Australian Securities and Investments Commission.

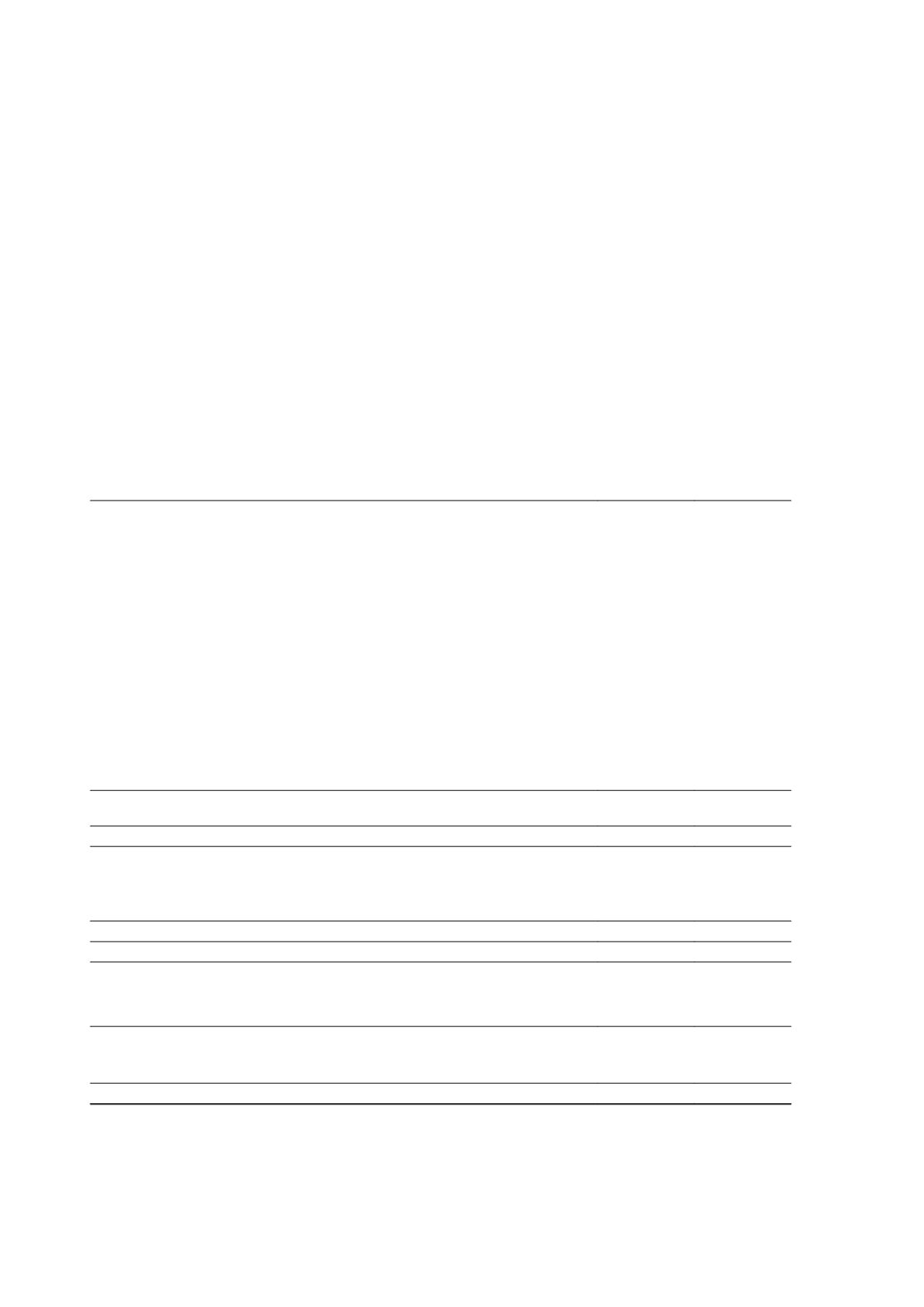

(a) Consolidated statement of profit or loss and other comprehensive income and summary of movements in

consolidated retained earnings

The above companies represent a 'closed group' for the purposes of the Class Order, and as there are no other parties

to the deed of cross guarantee that are controlled by Independence Group NL, they also represent the 'extended closed

group'.

Set out below is a consolidated statement of profit or loss and other comprehensive income and a summary of

movements in consolidated retained earnings for the year ended 30 June 2015 of the closed group consisting of

Independence Group NL, Independence Long Pty Ltd and Independence Jaguar Limited.

Consolidated statement of profit or loss and other comprehensive income

2015

$'000

Restated*

2014

$'000

Revenue from continuing operations

495,298

399,004

Other income

3,327

-

Mining, development and processing costs

(135,352)

(100,494)

Employee benefits expense

(63,841)

(61,196)

Share-based payments expense

(2,949)

(4,632)

Fair value movement of financial investments

1,467

(2)

Depreciation and amortisation expense

(95,959)

(66,521)

Rehabilitation and restoration borrowing costs

(271)

(269)

Exploration costs expensed

(21,184)

(22,930)

Royalty expense

(15,647)

(14,309)

Ore tolling expense

(12,297)

(11,973)

Shipping and wharfage expense

(19,539)

(17,551)

Borrowing and finance costs

(1,566)

(5,138)

Impairment of exploration and evaluation expenditure

(3,461)

(3,057)

Impairment of loans to subsidiaries

(4,278)

(12,518)

Other expenses

(11,004)

(9,362)

Profit before income tax

112,744

69,052

Income tax expense

(35,142)

(25,382)

Profit for the year

77,602

43,670

Other comprehensive income

Items that may be reclassified to profit or loss

Effective portion of changes in fair value of cash flow hedges, net of tax

2,038

(4,435)

Other comprehensive income for the year, net of tax

2,038

(4,435)

Total comprehensive income for the year

79,640

39,235

Summary of movements in consolidated retained earnings (accumulated

losses)

2015

$'000

Restated*

2014

$'000

Accumulated losses at the beginning of the financial year

(16,282)

(50,619)

Profit for the year

77,602

43,670

Dividends paid

(25,768)

(9,333)

Retained earnings (accumulated losses) at the end of the financial year

35,552

(16,282)

Independence Group NL

90