NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

Annual Report 2015 151

Notes to the consolidated financial statements

30 June 2015

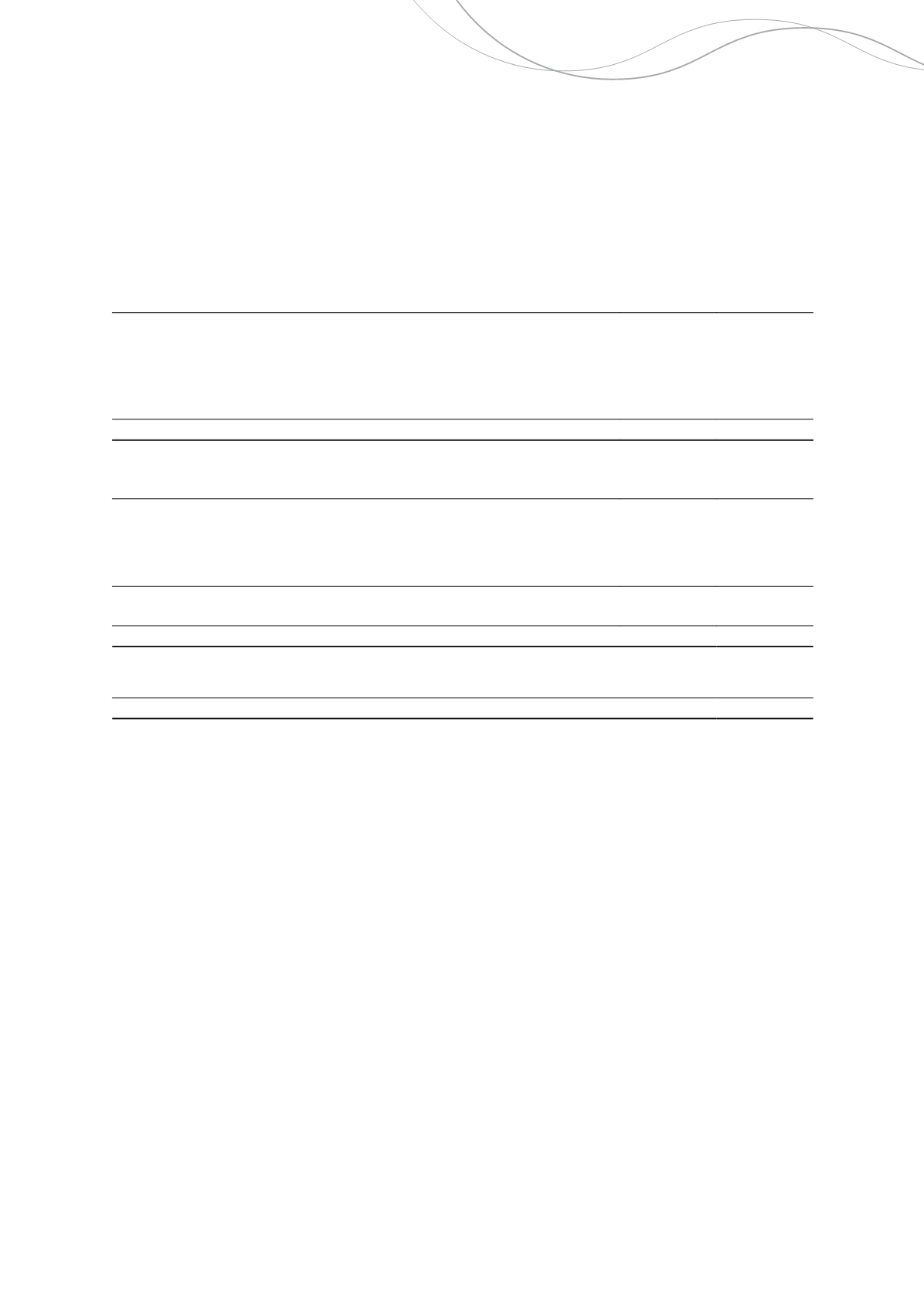

32 Commitments and contingencies

(a) Commitments

(i)

Leasing commitments

2015

$'000

2014

$'000

Operating lease commitments

Commitments for minimum lease payments in relation to non-cancellable operating

leases are payable as follows:

Within one year

1,275

1,374

Later than one year but not later than five years

5,516

6,768

Later than five years

1,242

1,242

Total minimum lease payments

8,033

9,384

2015

$'000

2014

$'000

Finance lease and hire purchase commitments

Future minimum lease payments under lease contracts with the present value of net

minimum lease payments are as follows:

Within one year

522

3,671

Later than one year but not later than five years

-

522

Total minimum lease payments

522

4,193

Future finance charges

(12)

(175)

Present value of minimum lease payments

510

4,018

Current

510

3,508

Non-current

-

510

Total included in borrowings

510

4,018

(ii)

Property, plant and equipment commitments

The Group had no specific contractual obligations to purchase plant and equipment at the reporting date (2014: $nil).

(b) Contingencies

The Group had guarantees outstanding at 30 June 2015 totalling $1,315,000 (2014: $15,950,000) which have been

granted in favour of various third parties. The guarantees primarily relate to environmental and rehabilitation bonds at

the various mine sites.

33 Events occurring after the reporting period

On 21 August 2015, the Company announced the establishment of a final dividend pool of $13,000,000. The record

date for this final dividend is expected to be no later than 30 September 2015. The final dividend will be fully franked.

On 25 May 2015, the Company and Sirius Resources NL ("Sirius") announced the execution of a binding Scheme

Implementation Deed ("SID") under which the Company will acquire all the issued capital of Sirius by way of an

Acquisition Scheme of Arrangement (the "Acquisition Scheme"). In addition, Sirius will also undertake a demerger of its

Polar Bear and Scandinavian exploration assets via a Demerger Scheme of Arrangement ("Demerger Scheme"),

whereby the assets will be held in a new listed vehicle called S2 Resources Ltd.

If successful, the transaction will be implemented via two inter-conditional Schemes of Arrangement (the Acquisition

Scheme and the Demerger Scheme), and a capital reduction to effect the demerger. In exchange for their shares, Sirius

shareholders will receive:

• 0.66 Independence Group shares for each Sirius share held;

• Cash consideration of 52 cents cash for each Sirius share held; and

• Circa one S2 share for every 2.5 Sirius shares held.

Independence Group NL

87