NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

Annual Report 2015 131

Notes to the consolidated financial statements

30 June 2015

10 Income tax expense (continued)

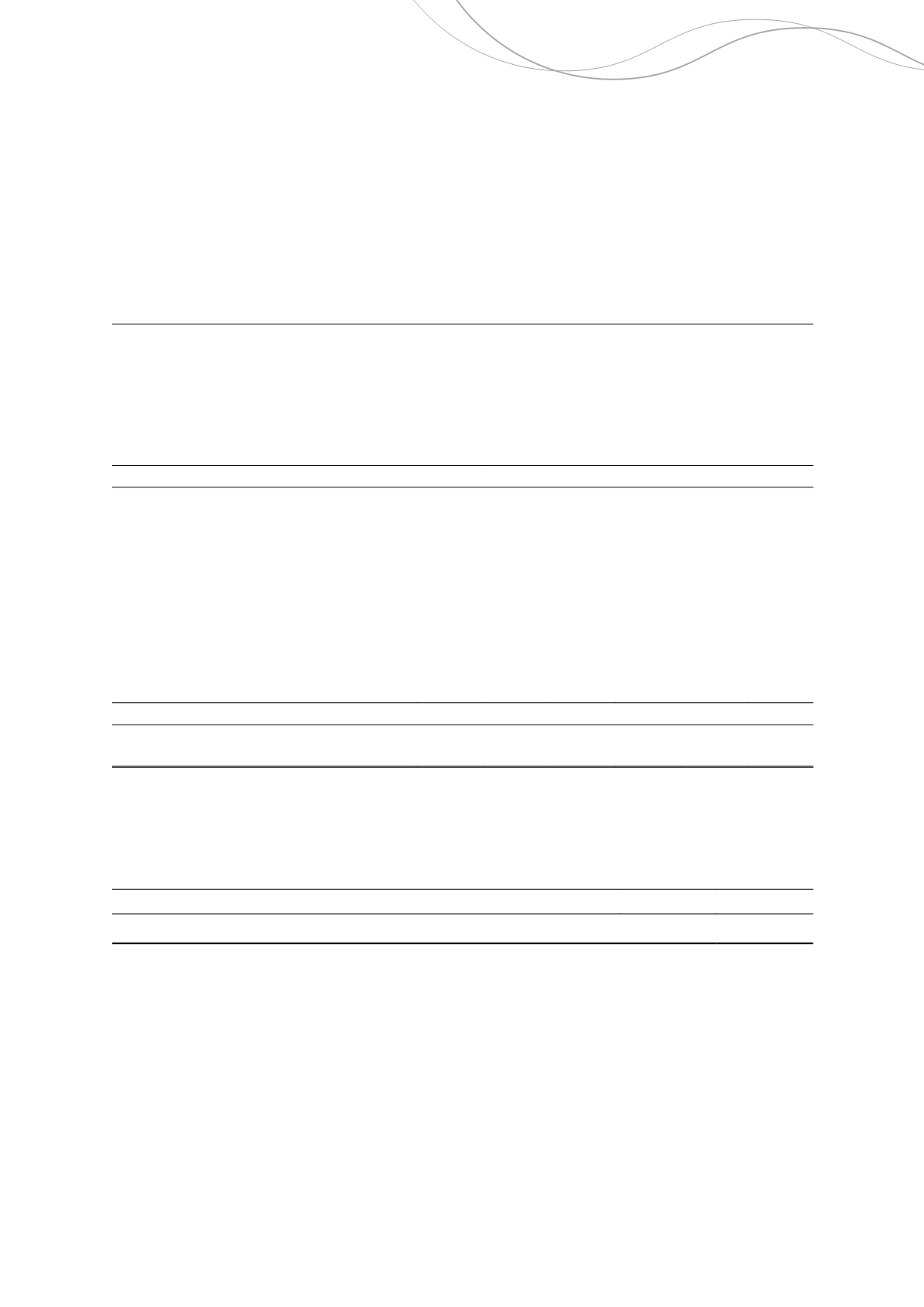

(d) Deferred tax assets and liabilities

Balance Sheet

Profit or loss

Equity

2015

$'000

Restated*

2014

$'000

2015

$'000

Restated*

2014

$'000

2015

$'000

Restated*

2014

$'000

Deferred tax liabilities

Capitalised exploration, pre-production and

acquisition costs

(24,914)

(30,935)

(6,021)

(568)

-

-

Capitalised development expenditure

(44,443)

(25,592)

18,851

21,595

-

-

Deferred gains and losses on hedging contracts

(1,467)

(900)

(697)

885

1,264

(2,663)

Trade debtors

(1,377)

(2,885)

(1,508)

1,388

-

-

Consumable inventories

(1,748)

(1,259)

489

97

-

-

Other

(31)

(31)

-

(381)

-

-

Gross deferred tax liabilities

(73,980)

(61,602)

11,114

23,016

1,264

(2,663)

Deferred tax assets

Property, plant and equipment

20,640

24,019

3,379

2,649

-

-

Deferred losses on hedged commodity contracts

904

1,862

1,148

(741)

(190)

763

Capitalised development expenditure

-

-

-

2,312

-

-

Concentrate inventories

398

32

(366)

534

-

-

Business-related capital allowances

908

1,402

494

1,196

-

-

Provision for employee entitlements

2,700

2,387

(313)

(470)

-

-

Provision for rehabilitation

8,298

7,205

(1,093)

(997)

-

-

Mining information

1,392

2,680

1,288

8,696

-

-

Carry forward tax losses

92,958

110,299

17,341

(13,042)

-

-

Other

2,319

2,509

190

(1,034)

-

-

Gross deferred tax assets

130,517

152,395

22,068

(897)

(190)

763

Deferred tax expense (income)

56,537

90,793

33,182

22,119

1,074

(1,900)

(e) Tax losses

In addition to the above recognised tax losses, the Group also has the following capital tax losses for which no deferred

tax asset has been recognised:

2015

$'000

2014

$'000

Unrecognised capital tax losses

2,403

2,576

Potential tax benefit @ 30% (2014: 30%)

721

773

(f) Tax consolidation

Members of the tax consolidated group and the tax sharing arrangement

Independence Group NL and its wholly owned subsidiaries formed a tax consolidated group with effect from 1 July

2002. Independence Group NL is the head entity of the tax consolidated group. Tax expense/income, deferred tax

liabilities and deferred tax assets arising from temporary differences of the members of the tax consolidated group are

recognised in the separate financial statements of the members of the tax consolidated group using the “separate tax

payer within group” approach. Current tax liabilities and assets and deferred tax assets arising from unused tax losses

and tax credits of the members of the tax consolidated group are recognised by the Company, as head entity in the tax

consolidated group.

Independence Group NL

67