NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

134 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

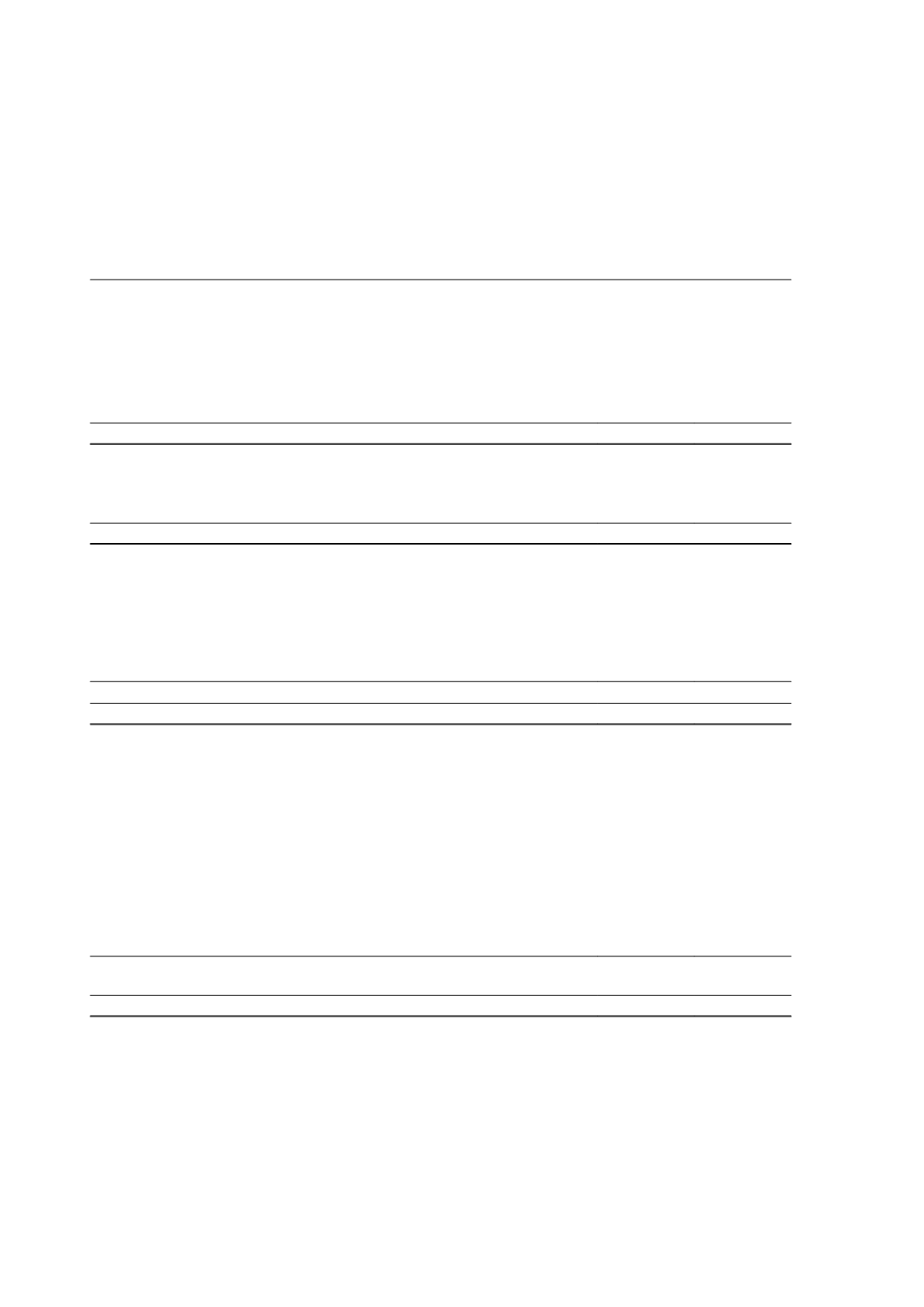

15 Inventories

2015

$'000

Restated*

2014

$'000

Current

Mine spares and stores - at cost

16,103

14,965

ROM inventory - at cost

9,670

3,834

Concentrate inventory - at cost

4,726

4,441

Concentrate inventory - at net realisable value

5,696

11,661

Work in progress - gold in process

881

499

Gold in circuit

798

1,510

Gold dore

2,424

3,473

40,298

40,383

Non-current

ROM inventory - at cost

24,979

8,803

24,979

8,803

Inventory classified as non-current relates to 0.6 to 1.2 g/t grade gold ore stockpiles which are not intended to be utilised

in the next 12 months but will be utilised over the life of the mine.

16 Current assets - Financial assets at fair value through profit or loss

2015

$'000

2014

$'000

Shares in Australian listed and unlisted companies - at fair value through profit or loss

15,574

858

15,574

858

The shares in Australian listed companies are valued at fair value through profit or loss and are all held for trading.

Changes in the fair values of these financial assets are recognised in the profit or loss and are valued using market

prices at year end.

The Group’s exposure to price risk and a sensitivity analysis for financial assets are disclosed in note 4.

During the current year, the changes in fair values of financial assets resulted in a gain to the profit or loss of

$1,467,000 (2014: $2,000 loss). Changes in fair values of financial assets at fair value through profit or loss are

recorded in fair value of financial investments in the profit or loss.

17 Non-current assets - Receivables

2015

$'000

2014

$'000

Prepayments

-

27

Term and other deposits

18

30

18

57

Independence Group NL

70