NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

Annual Report 2015 137

Notes to the consolidated financial statements

30 June 2015

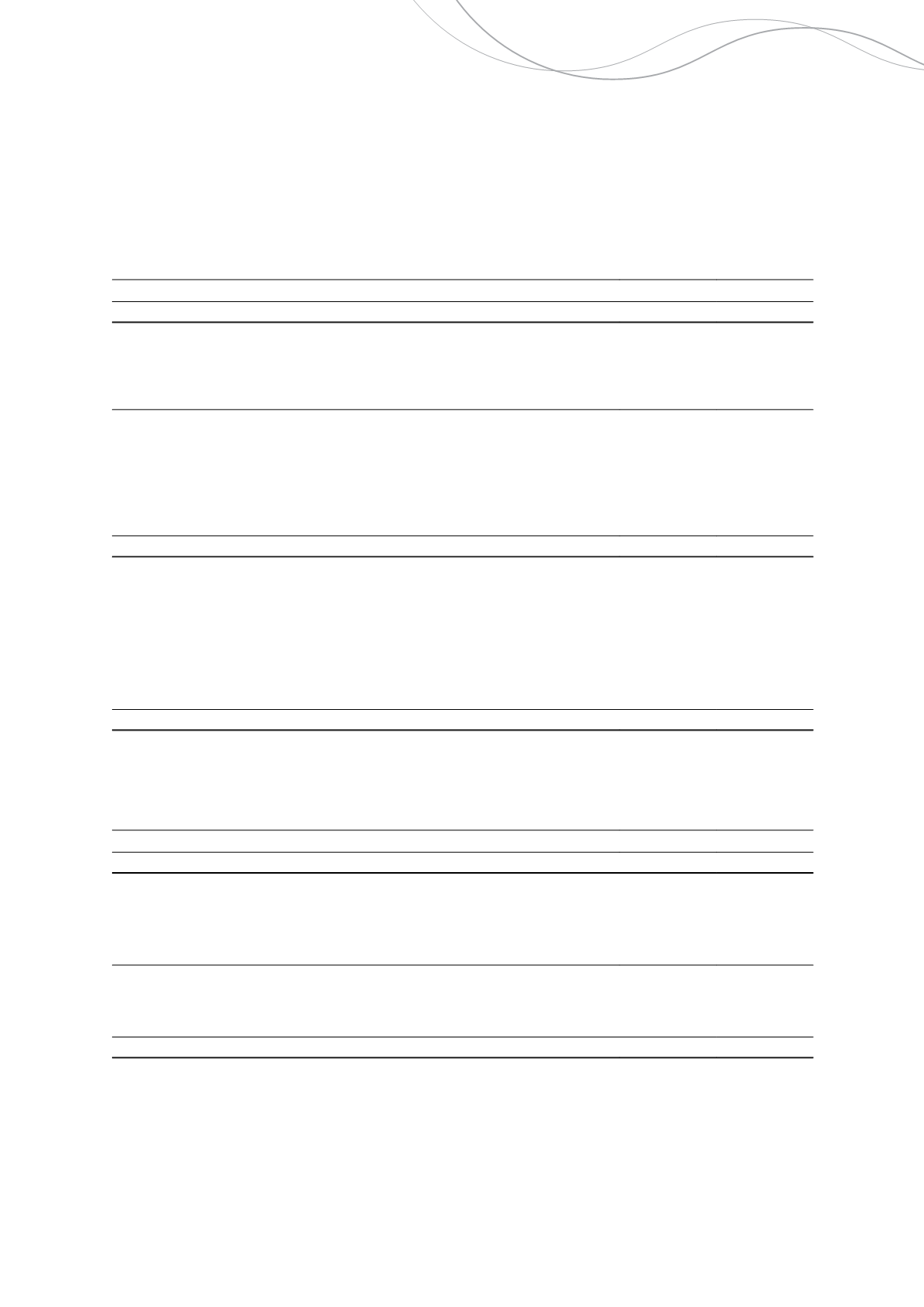

19 Non-current assets - Mine properties

2015

$'000

Restated*

2014

$'000

Mine properties in production

303,300

329,279

303,300

329,279

Reconciliations of the carrying amounts at the beginning and end of the financial year are as follows:

2015

$'000

Restated*

2014

$'000

Mine properties in development

Carrying amount at beginning of financial year

-

230,628

Additions

-

28,587

Transfers to property, plant and equipment

-

(17,215)

Transfers to mine properties in production

-

(242,717)

Borrowing costs capitalised

-

544

Depreciation expense capitalised

-

173

Carrying amount at end of financial year

-

-

Mine properties in production

Carrying amount at beginning of financial year

329,279

89,062

Additions

46,356

47,589

Transfers from exploration and evaluation expenditure

10,609

10,188

Transfers to property, plant and equipment

(1,033)

-

Transfers from mine properties in development

-

242,717

Transfers to inventories

-

(9,519)

Amortisation expense

(81,911)

(50,758)

Carrying amount at end of financial year

303,300

329,279

20 Non-current assets - Exploration and evaluation expenditure

2015

$'000

Restated*

2014

$'000

Exploration and evaluation costs

109,930

111,583

109,930

111,583

Reconciliations of the carrying amounts at the beginning and end of the financial year are as follows:

2015

$'000

Restated*

2014

$'000

Carrying amount at beginning of financial year

111,583

115,379

Additions

12,417

12,471

Transfers to mine properties in production

(10,609)

(10,188)

Impairment charge

(3,461)

(6,079)

Carrying amount at end of financial year

109,930

111,583

Exploration and evaluation assets are assessed for impairment when facts and circumstances suggest that the carrying

amount of an exploration and evaluation asset may exceed its recoverable amount. Management regularly evaluates

the recoverability of exploration and evaluation assets. The Group has impaired the following capitalised exploration and

evaluation costs during the reporting period:

Independence Group NL

73