NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

140 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

25 Derivative financial instruments (continued)

(i)

Instruments used by the Group

Derivative financial instruments are used by the Group in the normal course of business in order to hedge exposure to

fluctuations in foreign exchange rates and commodity prices.

The derivative financial instruments are classified as held for trading and accounted for at fair value through profit or

loss unless they are designated as cash flow hedges. The Group's accounting policy for its cash flow hedges is set out

in note 2(l).

The fair value of the derivative instruments at the reporting date is reflected in current and non-current assets and

liabilities in the balance sheet and is calculated by comparing the contracted rate to the market rates for derivatives with

the same length of maturity.

Refer to note 4 and below for details of the foreign currency and commodity prices risk being mitigated by the Group’s

derivative instruments as at 30 June 2015 and 30 June 2014.

Nickel

At 30 June 2015, the Group held various nickel commodity contracts denominated in US dollars ("USD"). Foreign

exchange contracts are also held which match the terms of the commodity contracts. These contracts are used to

reduce the exposure to a future decrease in the Australian dollar ("AUD") market value of nickel sales.

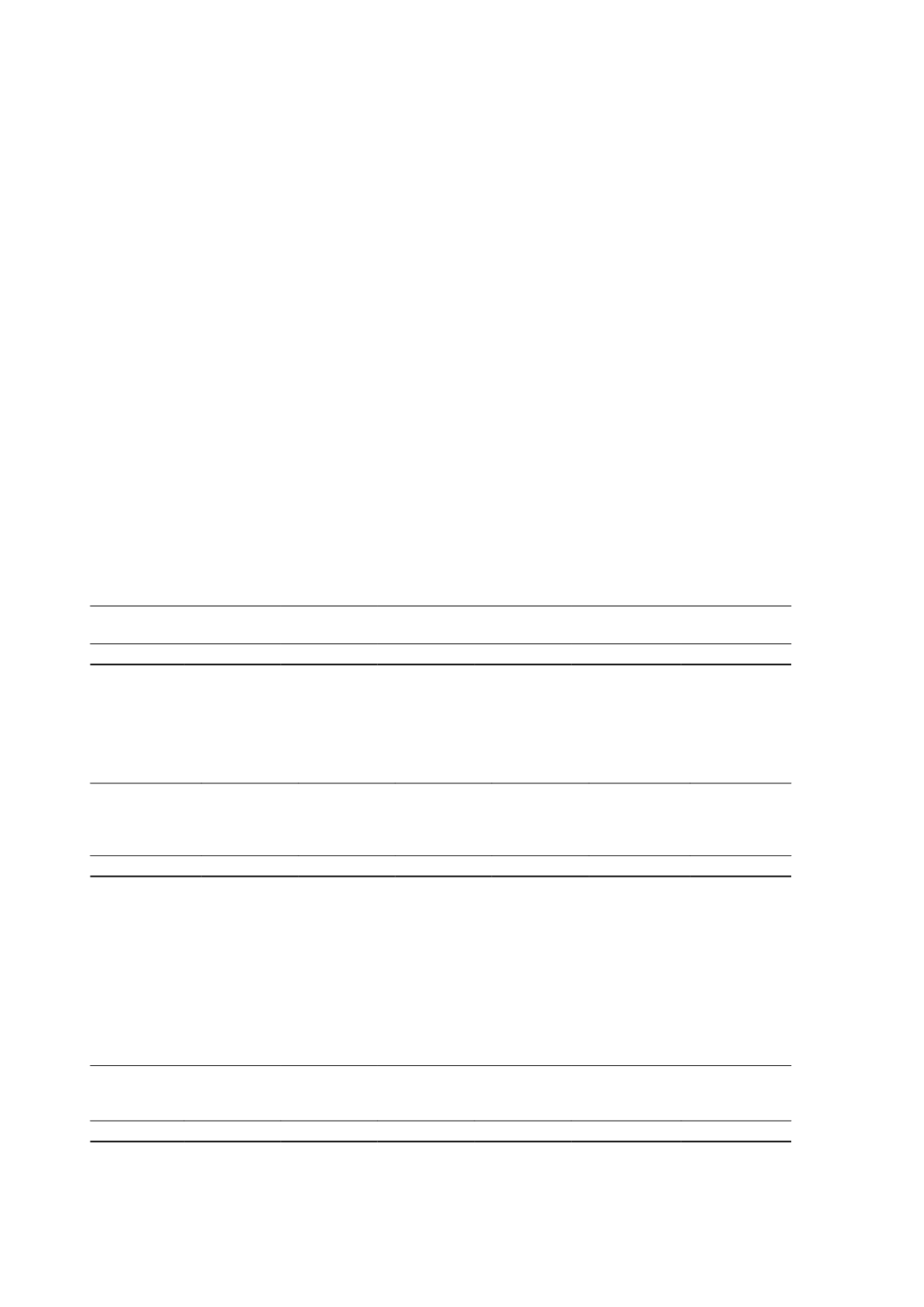

The outstanding nickel contracts held by the Group at 30 June 2015 are as follows:

Tonnes of metal

Weighted average price

(USD/metric tonne)

Fair value

2015

2014

2015

2014

2015

$'000

2014

$'000

0 - 6 months

750

1,200

16,711

16,816

4,626

(2,838)

6 - 12 months

-

1,200

-

16,401

-

(3,368)

Total

750

2,400

16,711

16,608

4,626

(6,206)

The following table details the forward foreign currency contracts outstanding at the reporting date:

Notional amounts (USD)

Weighted average

AUD:USD exchange rate

Fair value

2015

$'000

2014

$'000

2015

2014

2015

$'000

2014

$'000

Sell USD forward

0 - 3 months

12,534

10,174

0.8482

0.9368

(1,533)

29

3 - 6 months

-

10,005

-

0.9212

-

140

6 - 12 months

-

19,681

-

0.9036

-

493

Total

12,534

39,860

0.8482

0.9163

(1,533)

662

Copper

At 30 June 2015, the Group held various copper commodity contracts denominated in USD. Foreign exchange

contracts are also held which match the terms of the commodity contracts. These contracts are used to reduce the

exposure to a future decrease in the AUD market value of copper sales.

The outstanding copper contracts held by the Group at 30 June 2015 are as follows:

Tonnes of metal

Weighted average price

(USD/metric tonne)

Fair value

2015

2014

2015

2014

2015

$'000

2014

$'000

0 - 3 months

550

1,200

6,261

6,889

355

(175)

3 - 6 months

-

550

-

7,178

-

96

6 - 12 months

-

950

-

7,303

-

313

Total

550

2,700

6,261

7,093

355

234

Independence Group NL

76