NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

142 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

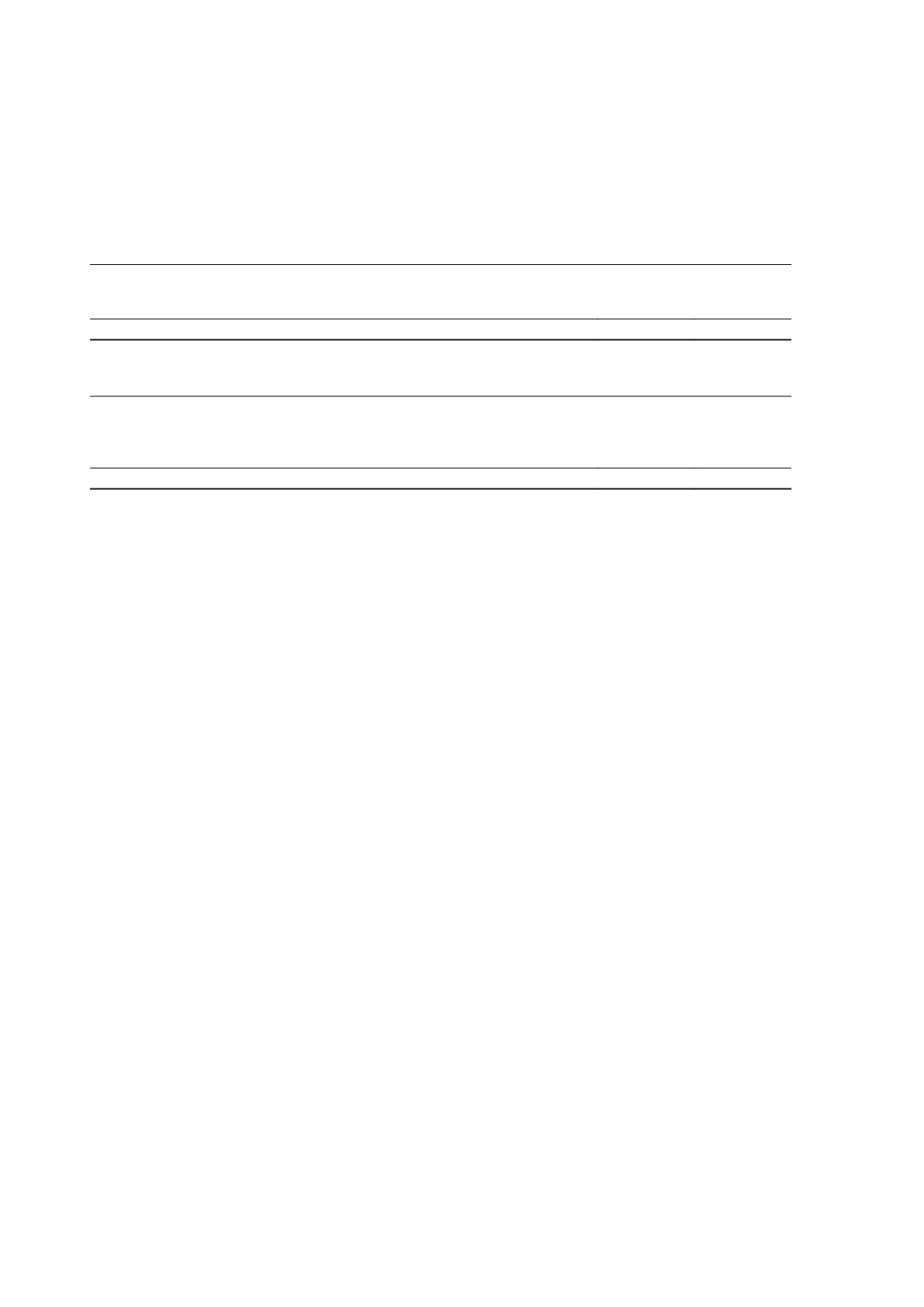

26 Borrowings

2015

$'000

2014

$'000

Current

Secured

Lease liabilities

510

3,508

Total secured current borrowings

510

3,508

2015

$'000

2014

$'000

Non-current

Secured

Bank loans

-

24,344

Lease liabilities

-

510

Total secured non-current borrowings

-

24,854

(a) Corporate loan facility

On 1 March 2013, the Company entered into a Corporate Loan Facility (Facility) with National Australia Bank. The

Facility comprised a corporate debt facility of $130,000,000 (of which $110,000,000 was cancelled during the year,

leaving an available facility of $20,000,000), an asset finance facility of $20,000,000 and a contingent instrument facility

of $20,000,000.

Total capitalised transaction costs to 30 June 2015 are $nil (2014: $2,377,000). Transaction costs are accounted for

under the effective interest rate method. These costs are incremental costs that are directly attributable to the loan and

include loan origination fees, commitment fees and legal fees. There are no unamortised transaction costs at 30 June

2015. At 30 June 2014, a balance of unamortised transaction costs of $656,000 was offset against the bank loans

contractual liability of $25,000,000.

No borrowing costs were capitalised in the current year. In the prior year, borrowing costs of $544,000 related to a

qualifying asset (Tropicana Gold Project) and were capitalised in accordance with AASB 123

Borrowing Costs

. Refer to

note 19.

The Facility has certain financial covenants that the Company has to comply with. All such financial covenants have

been complied with in accordance with the Facility.

In addition to the above Facility, the Group had an additional asset finance facility with Australia and New Zealand

Banking Group Limited in the prior year of $420,000. This facility expired during the year and all outstanding lease

contracts were repaid in full.

Refer to note 33 for details of a new financing facility entered into by the Company in July 2015.

(b) Interest rate, foreign exchange and liquidity risk

Details regarding interest rate, foreign exchange and liquidity risk are disclosed in note 4.

(c) Assets pledged as security

There are no assets pledged as security for non-current borrowings at 30 June 2015. The carrying amount of assets

pledged as security for non-current borrowings at 30 June 2014 was $25,000,000. The security is provided under a

General Security Agreement and is on arm’s length commercial terms with the financier.

Lease liabilities are effectively secured as the rights to the leased assets recognised in the financial statements revert to

the lessor in the event of default.

In addition to the above, $1,315,000 (2014: $15,950,000) is pledged as security in relation to the contingent instrument

facility.

Independence Group NL

78