NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

148 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

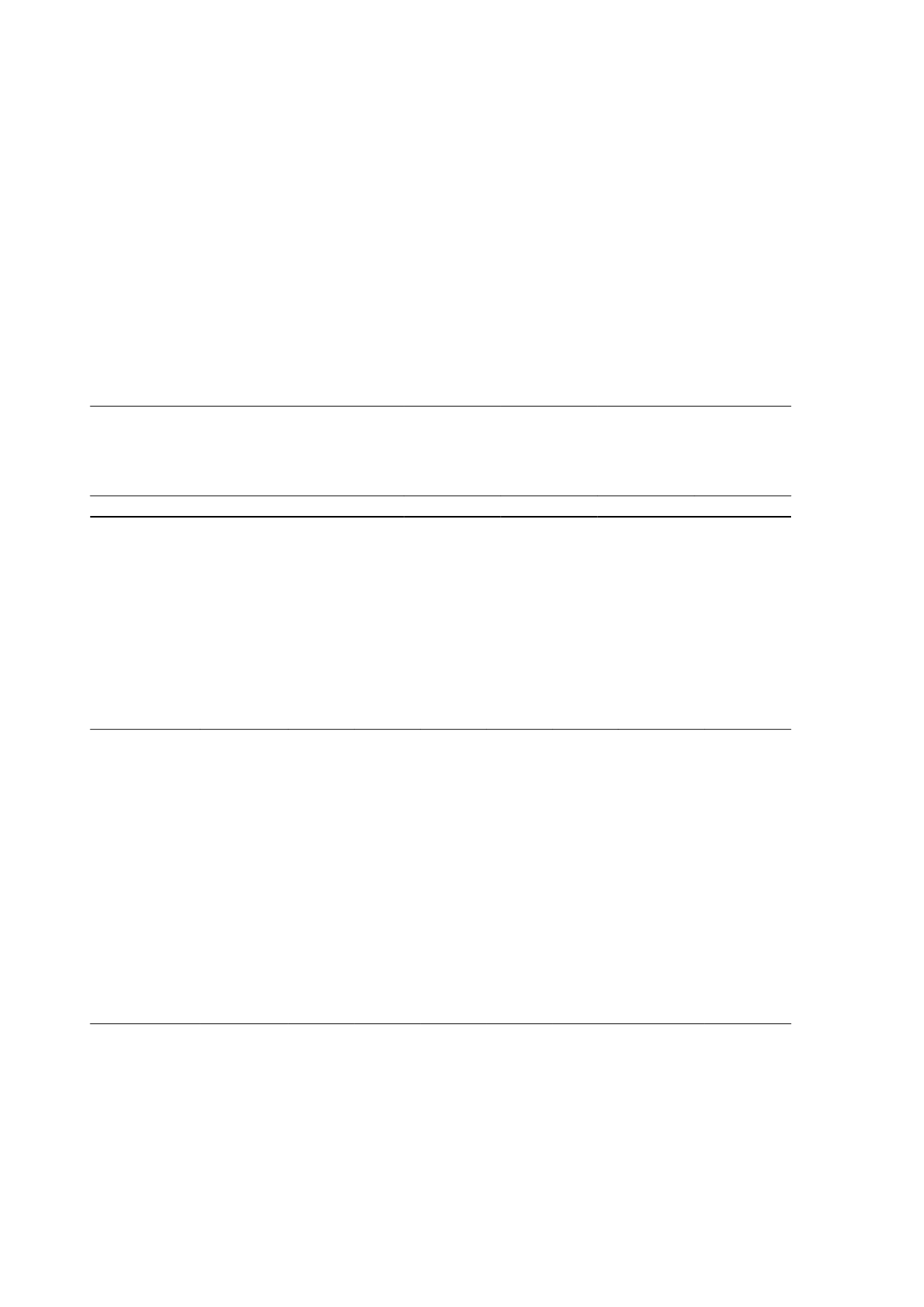

31 Share-based payments

(a) Employee Performance Rights Plan

The Independence Group NL Employee Performance Rights Plan ("PRP") was approved by shareholders at the Annual

General Meeting of the Company in November 2011. Under the PRP, participants are granted share rights which will

only vest if certain performance conditions are met and the employees are still employed by the Group at the end of the

vesting period. Participation in the PRP is at the Board’s discretion and no individual has a contractual right to

participate in the plan or to receive any guaranteed benefits.

2015

2014

Number of

share rights

Weighted

average fair

value

Number of

share rights

Weighted

average fair

value

Outstanding at the beginning of the year

3,255,175

2.99

3,239,280

2.66

Rights issued during the year

509,480

2.65

1,821,215

3.29

Rights vested during the year

(932,668)

3.00

(441,370)

3.93

Rights lapsed during the year

(518,230)

3.23

(1,231,204)

3.62

Rights cancelled during the year

-

-

(132,746)

2.04

Outstanding at the end of the year

2,313,757

2.85

3,255,175

2.99

Fair value of share rights granted

The fair value of the share rights granted under the PRP is estimated at the grant date using a trinomial tree which has

been adopted by the Boyle and Law (1994) node alignment algorithm to improve accuracy.

The following table lists the inputs to the models used.

Grant date

Performance

hurdle

Dividend

yield

Expected

stock

volatility

Expected

peer

group/

index

volatility*

Risk free

rate

Effective

life

Weighted

average

share price at

grant date

Probability

ROE

exceeding

target

% % % % Years

$

%

09/01/2015

TSR

2.17

42

63

2.15

2.5

4.60

-

21/11/2014

TSR

2.40

44

62

2.56

2.6

4.16

-

28/02/2014

TSR

1.45

48

22

2.70

0.3

4.13

-

28/02/2014

TSR

1.45

43

24

2.95

2.3

4.13

-

28/02/2014

ROE

-

-

-

-

-

-

<50

21/11/2012

TSR

0.47

41

24

2.64

2.6

4.29

-

21/11/2012

ROE

-

-

-

-

-

-

<50

28/02/2013

TSR

0.45

40

22

2.67

0.3

4.47

-

28/02/2013

TSR

0.45

40

23

2.72

2.3

4.47

-

28/02/2013

ROE

-

-

-

-

-

-

<50

23/11/2011

TSR

1.07

54

30

3.09

2.6

4.69

-

23/11/2011

ROE

-

-

-

-

-

-

<50

13/03/2012

TSR

0.72

46

29

3.56

0.3

4.17

-

13/03/2012

TSR

0.72

46

29

3.56

2.3

4.17

-

13/03/2012

ROE

-

-

-

-

-

-

<50

1. The peer group volatility is calculated as the average volatility of the 22 peer group companies.

The share-based payments expense included in profit or loss for the year totalled $2,949,000 (2014: $4,632,000).

Independence Group NL

84