DIRECTORS’ REPORT

Annual Report 2015 71

Directors' report

30 June 2015

Operating and financial review (continued)

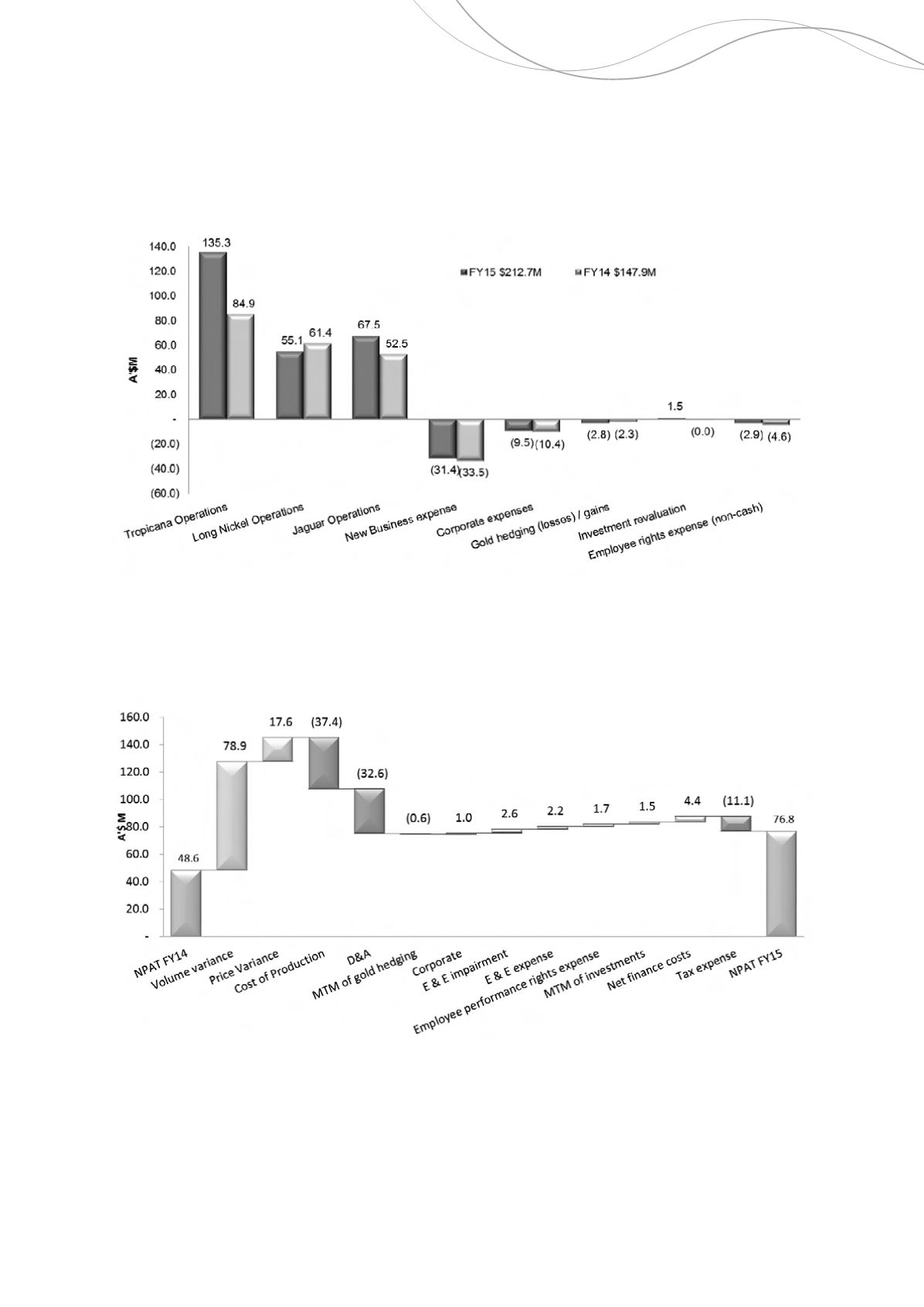

Net profit after tax ("NPAT") for the year of $76.8 million outperformed the 2014 financial year NPAT of $48.6 million.

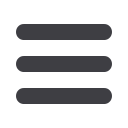

The chart below outlines the key drivers of the results for FY2015 compared to the corresponding year. 90% of the

volume variance is driven by a full year’s gold production from Tropicana. In addition, zinc contributed 21%, with falls in

output from Long (10%). The cost of production increase and depreciation and amortisation charge also relates

primarily to Tropicana’s full year of operations.

During the year, the Group adopted a voluntary change in accounting policy whereby exploration and evaluation

expenditure that is incurred is capitalised only if it is anticipated that future economic benefits are more likely than not to

be generated as a result of the expenditures. Otherwise, exploration and evaluation expenditure will be expensed. The

change in accounting policy has been adopted retrospectively, and hence prior year’s reported figures in this financial

report may differ from figures reported in last years’ financial report.

Independence Group NL

6