DIRECTORS’ REPORT

72 Independence Group NL

Directors' report

30 June 2015

Operating and financial review (continued)

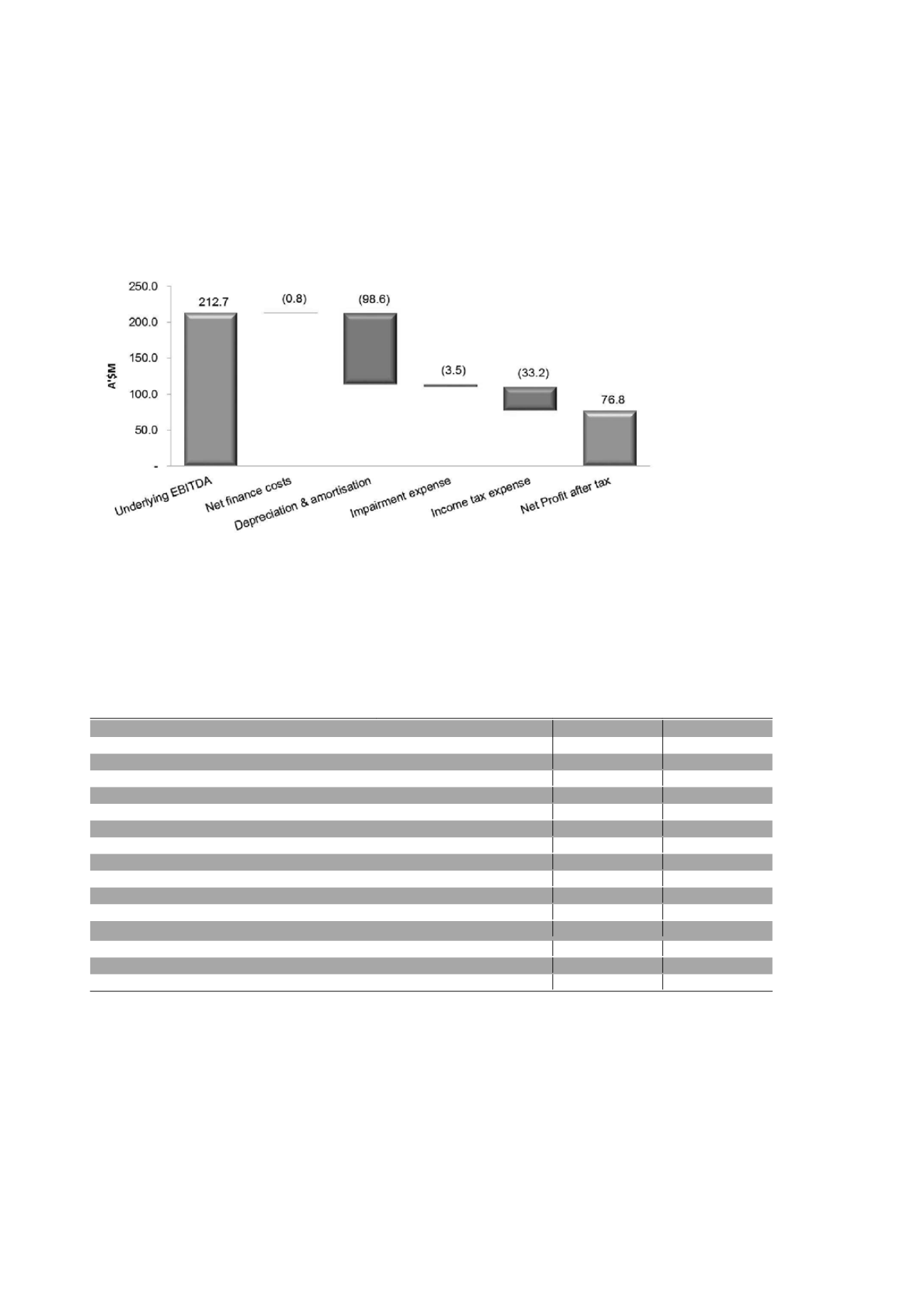

Below is a reconciliation of Underlying EBITDA to NPAT for FY2015:

Depreciation and amortisation expense (“D&A”) of $98.6 million includes $55.9 million relating to Tropicana, $21.9

million to Long Operations, $19.7 million to Jaguar Operations and the balance to corporate assets. Jaguar’s D&A

increased by 108% during the year, primarily as a result of increased amortisation from a higher proportion of ore

sourced from reserves compared to the previous year, together with additional depreciation charges following the

replenishment of the underground haulage and production fleet.

Operations

Tropicana Gold Project

The table below outlines the key results and operational statistics during the current and prior year.

Tropicana Gold Mine

2015

2014*

Total revenue

$'000

218,966

137,918

Segment operating profit before tax

$'000

76,117

48,332

Total segment assets

$'000

645,071

440,585

Total segment liabilities

$'000

31,748

29,705

Gold ore mined (>0.6g/t Au)

'000 wmt

10,763

5,721

Gold ore mined (>0.4 and 0.6g/t Au)

'000 wmt

1,601

1,088

Waste mined

'000 wmt

42,761

25,251

Gold grade mined (>0.6g/t)

g/t

2.06

2.22

Ore milled

'000 wmt

5,826

4,043

Gold grade milled

g/t

2.92

3.02

Metallurgical recovery

%

90.2

89.4

Gold recovered

Ounces

492,780

350,743

Gold produced

Ounces

496,413

348,371

Gold refined and sold (IGO share)

Ounces

150,836

100,167

Cash Costs

$ per ounce produced

568

552

All-in Sustaining Costs ("AISC")**

$ per ounce sold

795

740

* 2014 refers to the period October 2013 to June 2014 being the period when the first full month of commissioning commenced.

** All-in Sustaining costs is a measure derived by the World Gold Council. On 27 June 2013, the Council released a publication outlining

definitions of both Cash Costs and All-in Sustaining Costs.

Independence Group NL

7