DIRECTORS’ REPORT

Annual Report 2015 73

Directors' report

30 June 2015

Operating and financial review (continued)

Operations (continued)

Tropicana Gold Project (continued)

Total revenue increased by 59% as a result of a full year’s production, post commissioning. Total segment assets

increased by 46% due to ongoing contributions by the Company to the operation by way of cash calls paid to the joint

venture manager. Cash calls paid during the year totalled $142.5 million (2014: $110.2 million). Another significant

contribution to total assets includes capitalised inventories (increase of 97% to $43.8 million). This is the outcome of the

current mining strategy to mine and process higher grade ore in the initial three years of production. At year end, the

capitalised run of mine stockpile comprised ore > 0.6g/t and totalled 8.9 million tonnes grading an average of 1.09g/t

(2014: 3.2 million tonnes at 1.22g/t).

Based on current ore reserves, the mine currently has a life of approximately eight years.

Long Operation

Independence Long Pty Ltd has entered into a long term ore tolling agreement with BHPB Nickel West whereby the

Group is paid for the nickel metal contained in the ore mined, less applicable ore toll charges. Revenue from nickel

sales is priced on a quotational period of three months after the month of production. 70% of the sales receipt is

provisionally paid based on the average London Metals Exchange ("LME") price for the month of delivery; a balancing

adjustment is paid in the fourth month after delivery based on the average LME price of the third month after delivery.

The mine produced 10,198 tonnes of contained nickel during the year at payable cash costs including royalties (net of

copper credits) of $4.01 per pound (2014: $3.78 per pound).

The Long Operation constitutes an operating segment as disclosed in the Financial Report. During the year a total of

258,634 tonnes of ore was mined, sourced from Moran - 68%, Long Lower - 15%, McLeay - 12% and Victor South - 5%.

The majority of ore continued to be mined from long hole stoping (70%) with lesser amounts coming from other

mechanised mining methods and non-mechanised methods.

Total segment revenue decreased by 6% during 2015; a result which is volume driven with 6% lower payable nickel

sold. Net operating profit before income tax fell 12% during 2015 due to lower nickel tonnage sold together with 6%

higher cash costs during the year.

Based on current ore reserves, the mine currently has a life of approximately two and a half years.

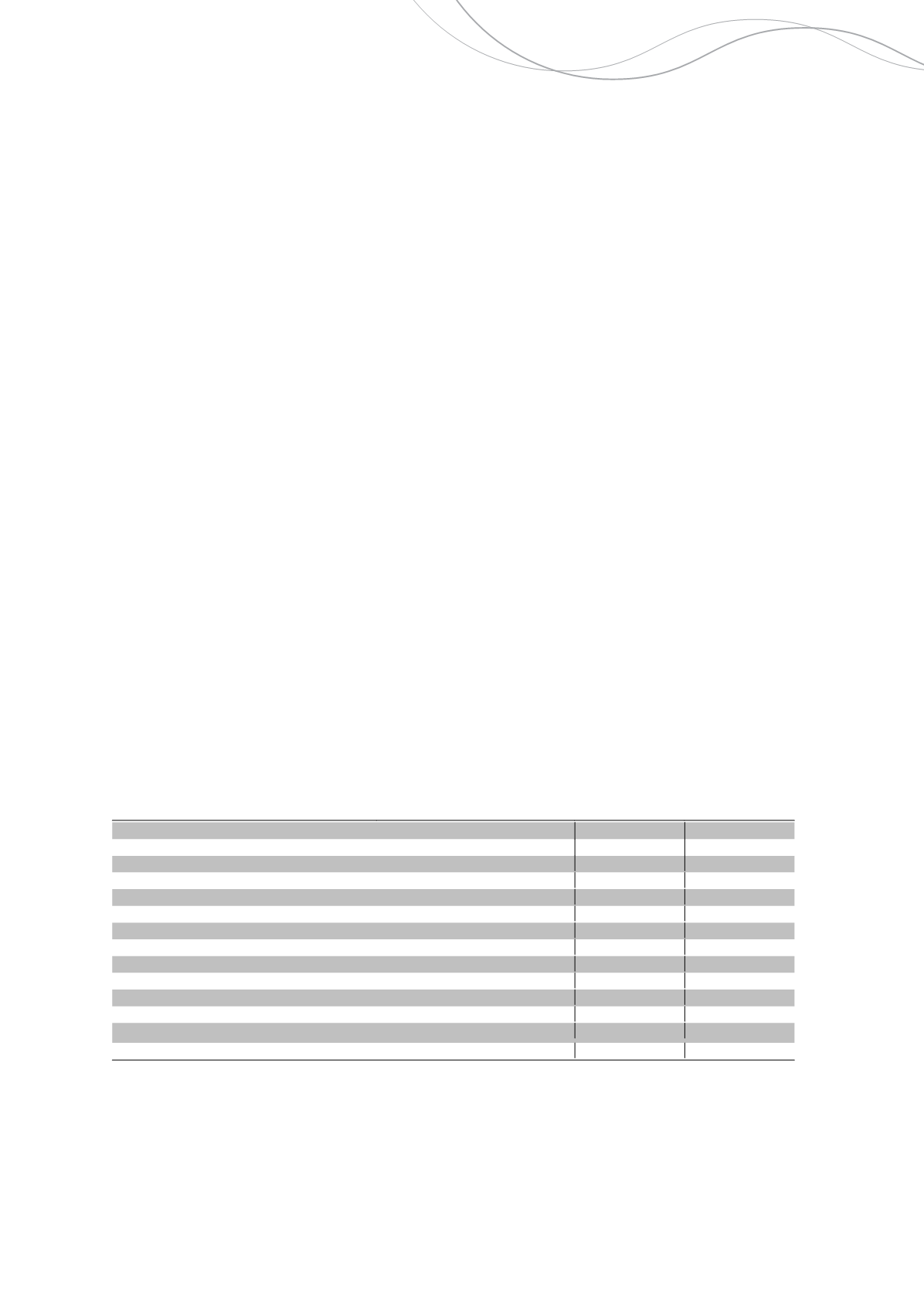

The table below highlights the key results and operational statistics during the current and prior year.

Long Nickel Mine

2015

2014

Total revenue

$'000

111,423

118,859

Segment operating profit before tax

$'000

32,180

37,233

Total segment assets

$'000

92,546

111,854

Total segment liabilities

$'000

36,180

29,960

Ore mined

Tonnes

258,634

268,162

Nickel grade

Head %

3.94

4.07

Copper grade

Head %

0.28

0.29

Tonnes milled

Tonnes

258,634

268,162

Nickel delivered

Tonnes

10,198

10,909

Copper delivered

Tonnes

723

769

Metal payable (IGO share)

- Nickel

Tonnes

6,151

6,589

- Copper

Tonnes

293

312

Ni cash costs and royalties

A$ payable metal per pound

4.01

3.78

* Cash costs include credits for copper

Independence Group NL

8