NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

108 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

2 Summary of significant accounting policies (continued)

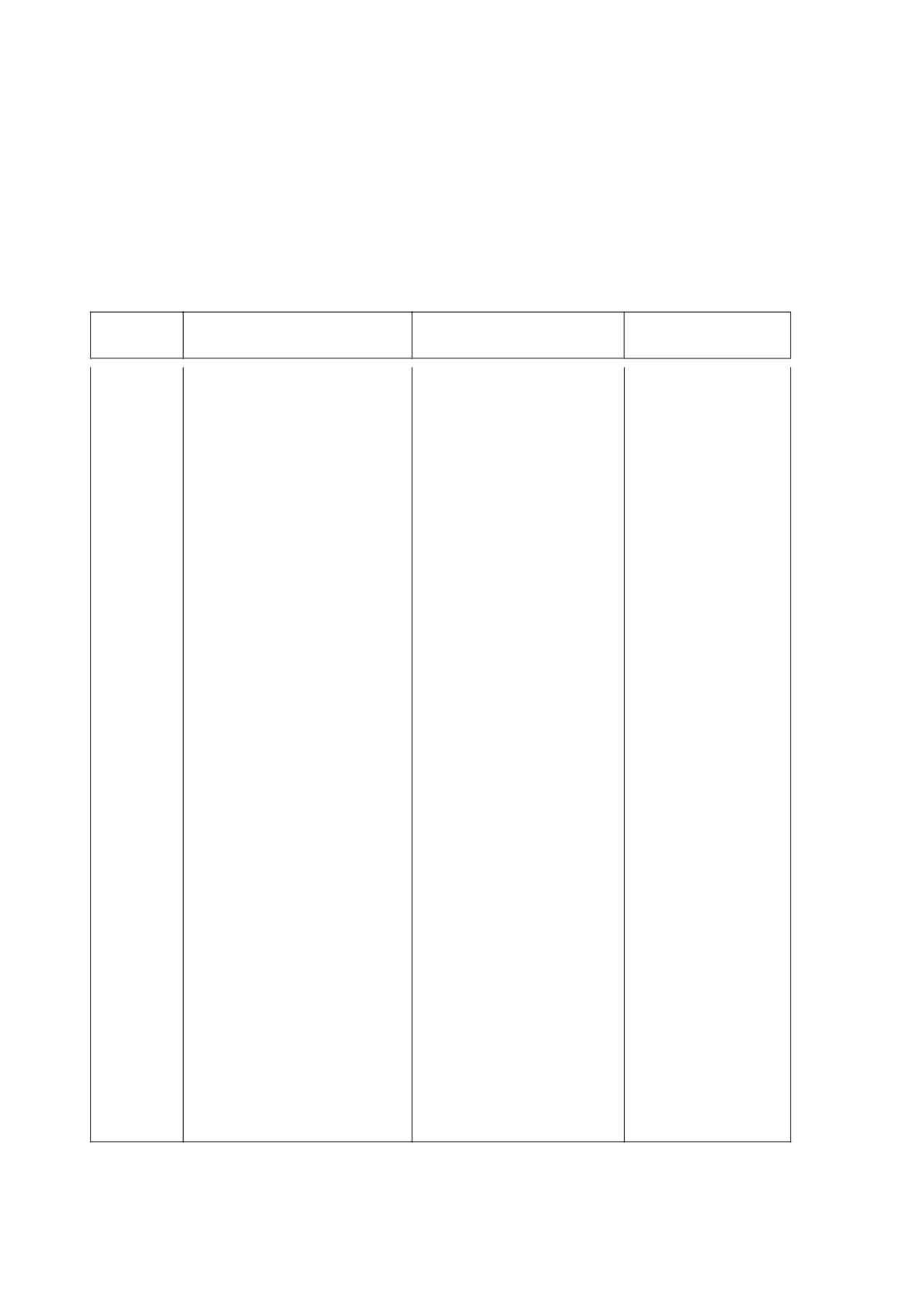

(af) New standards and interpretations not yet adopted

Certain new accounting standards and interpretations have been published that are not mandatory for 30 June 2015

reporting periods and have not been early adopted by the Group. The Group’s assessment of the impact of these new

standards and interpretations is set out below.

Title of

standard Nature of change

Impact

Mandatory application

date/ Date of adoption

by group

AASB 9

Financial

Instruments

(issued

December

2014)

Classification and measurement

AASB 9 amendments the

classification and measurement of

financial assets:

• Financial assets will either be

measured at amortised cost, fair

value through other comprehensive

income ("FVTOCI") or fair value

through profit or loss ("FVTPL").

• Financial assets are measured at

amortised cost or FVTOCI if certain

restrictive conditions are met. All

other financial assets are measured

at FVTPL.

• All

investments in equity

instruments will be measured at fair

value. For those investments in

equity instruments that are not held

for trading, there is an irrevocable

election to present gains and losses

in OCI.

Dividends will

be

recognised in profit or loss.

The following requirements have

generally been carried forward

unchanged from AASB 139

Financial Instruments: Recognition

and Measurement into AASB 9:

• Classification and measurement

of financial liabilities, and

• Derecognition requirements for

financial assets and liabilities.

However, AASB 9 requires that

gains or losses on financial

liabilities measured at fair value are

recognised in profit or loss, except

that the effects of changes in the

liability’s credit risk are recognised

in other comprehensive income.

Impairment

The new impairment model in

AASB 9 is now based on an

‘expected loss’ model rather than

an ‘incurred loss’ model.

A complex three stage model

applies to debt instruments at

amortised cost or at fair value

through other

comprehensive

income for recognising impairment

losses.

Adoption of AASB 9 is only

mandatory for the year ending

30 June 2019.

This standard is not expected to

impact the Group as financial

assets are currently classified

through profit or loss.

The entity currently applies

hedge accounting. It is expected

that the application of the new

amendments will not have an

impact on the entity’s financial

statements.

The new impairment model is an

expected credit loss ("ECL")

model which may result in the

earlier recognition of credit

losses.

Mandatory for financial

years commencing on or

after 1 January 2018.

Expected date of

adoption by the group: 1

July 2018.

Independence Group NL

44