NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

112 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

2 Summary of significant accounting policies (continued)

(af) New standards and interpretations not yet adopted (continued)

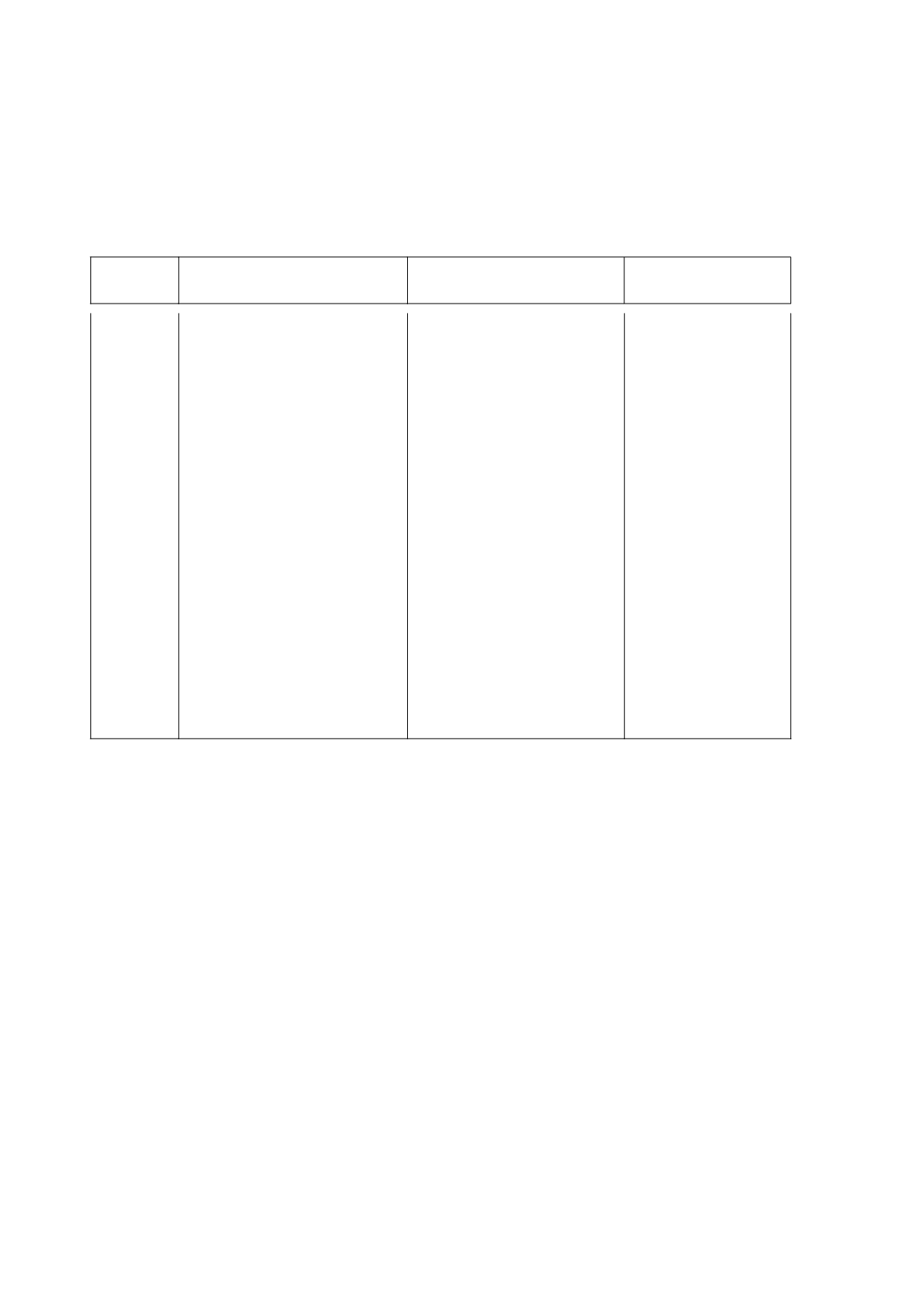

Title of

standard Nature of change

Impact

Mandatory application

date/ Date of adoption

by group

AASB

2014-10

(issued

December

2014)

Amendments

to

Australian

Accounting

Standards -

Sale or

Contribution

of Assets

between

An Investor

and its

Associate

or Joint

Venture

Removes the inconsistency

between AASB 10

Consolidated

Financial Statements

and AASB 128

Investments in Associates and Joint

Ventures

in accounting for

transactions where a parent loses

control over a subsidiary that is not

a business under AASB 3

Business

Combinations

, by selling part of its

interest to an associate or joint

venture, or by selling down part of

its interest so that the remaining

investment becomes an associate

or joint venture. Requires that:

• Gain or loss from measuring the

retained interest in the former

subsidiary at fair value, as well as

gains or losses to be reclassified

from other comprehensive income

to profit or loss, only be recognised

to the extent of the unrelated

investor’s interest in that associate

or joint venture, and

• Remaining gains or losses to be

eliminated against the investment in

associate or joint venture.

There will be no impact on the

financial statements when these

amendments are first adopted

because they apply prospectively

to sales or contributions of assets

occurring after the application

date.

Mandatory for financial

years commencing on or

after 1 January 2016.

Expected date of

adoption by the Group: 1

July 2016

There are no other standards that are not yet effective and that would be expected to have a material impact on the

entity in the current or future reporting periods and on foreseeable future transactions.

Independence Group NL

48