NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

Annual Report 2015 109

Notes to the consolidated financial statements

30 June 2015

2 Summary of significant accounting policies (continued)

(af) New standards and interpretations not yet adopted (continued)

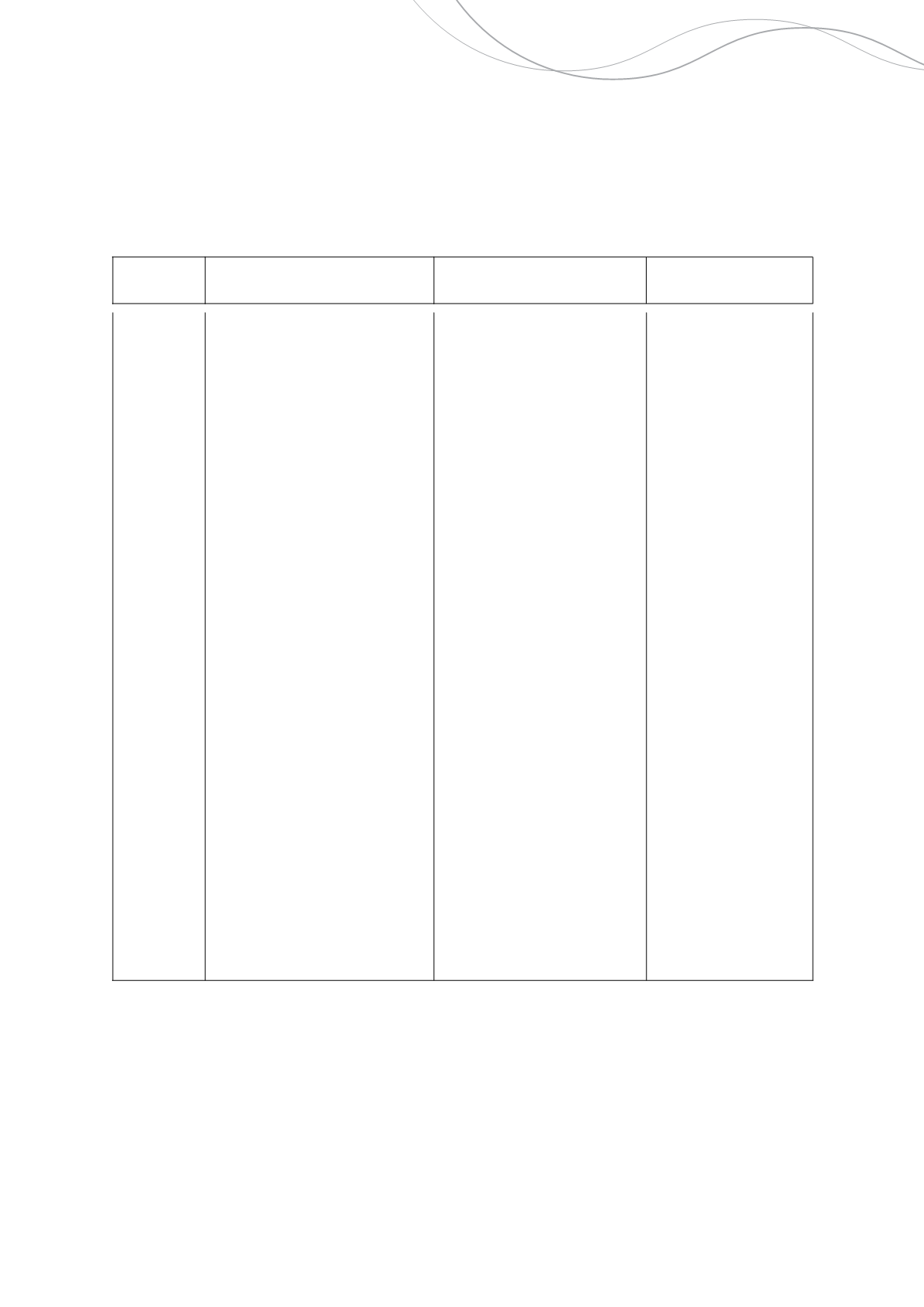

Title of

standard Nature of change

Impact

Mandatory application

date/ Date of adoption

by group

AASB 9

Financial

Instruments

(issued

December

2014)

(continued)

A simplified impairment model

applies to trade receivables and

lease receivables with maturities

that are less than 12 months.

For trade receivables and lease

receivables with maturity longer

than 12 months, entities have a

choice of applying the complex

three stage model or the simplified

model.

Hedge accounting

Under the new hedge accounting

requirements:

• The 80-125% highly effective

threshold has been removed.

• Risk components of non-financial

items can qualify for hedge

accounting provided that the risk

component is separately identifiable

and reliably measurable.

• An aggregated position (i.e.

combination of a derivative and a

non-derivative) can qualify for

hedge accounting provided that it is

managed as one risk exposure.

• When entities designate the

intrinsic value of options, the initial

time value is deferred in OCI and

subsequent changes in time value

are recognised in OCI.

• When entities designate only the

spot element of a forward contract,

the forward points can be deferred

in OCI and subsequent changes in

forward points are recognised in

OCI. Initial foreign currency basis

spread can also be deferred in OCI

with subsequent

changes be

recognised in OCI.

• Net foreign exchange cash flow

positions can qualify for hedge

accounting.

Independence Group NL

45