NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

110 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

2 Summary of significant accounting policies (continued)

(af) New standards and interpretations not yet adopted (continued)

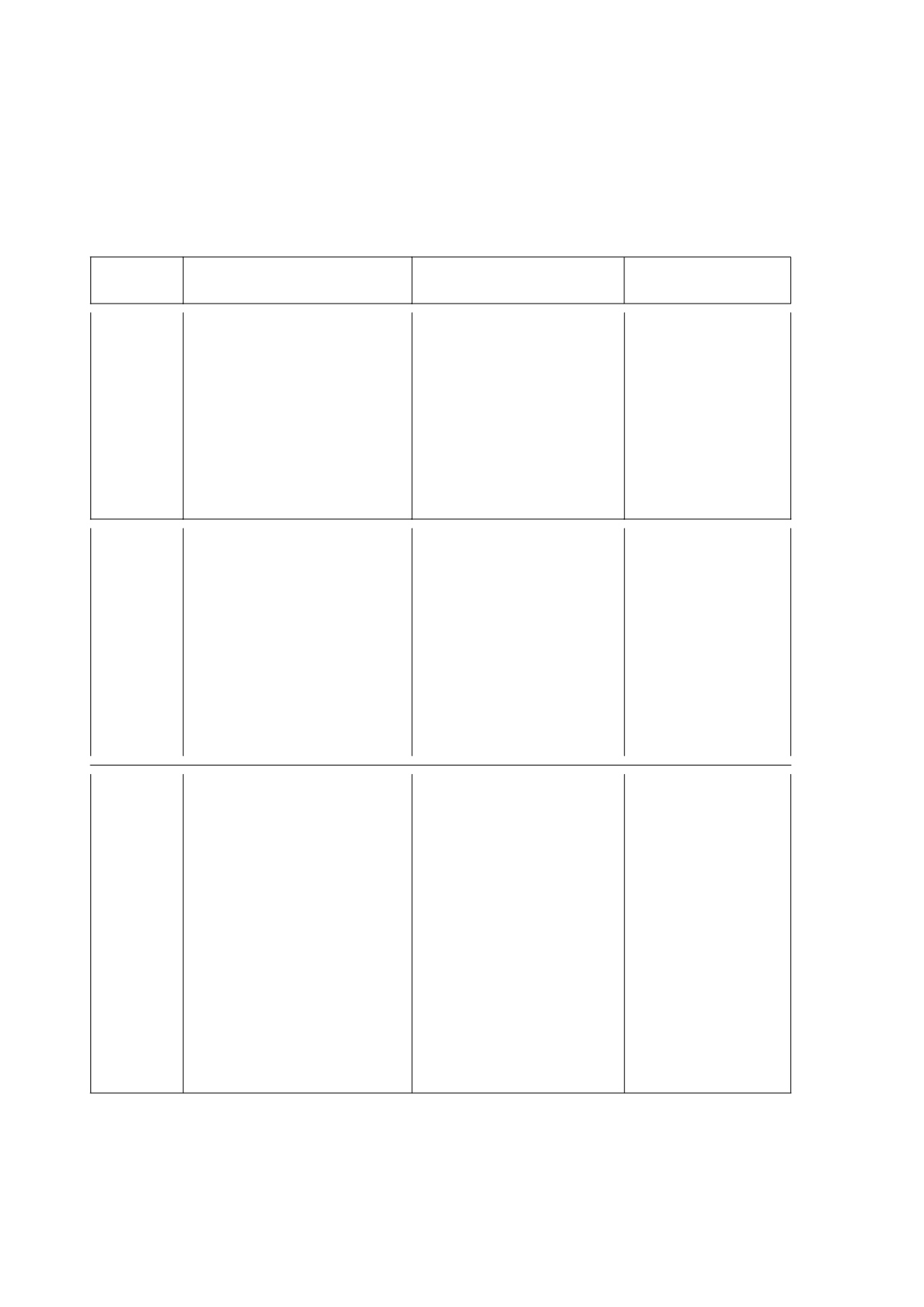

Title of

standard Nature of change

Impact

Mandatory application

date/ Date of adoption

by group

AASB 15

Revenue

from

Contracts

with

Customers

(issued

December

2014)

An entity will recognise revenue to

depict the transfer of promised

goods or services to customers in

an amount that reflects the

consideration to which the entity

expects to be entitled in exchange

for those goods or services. This

means that revenue will

be

recognised when control of goods

or services is transferred, rather

than on transfer of risks and

rewards as is currently the case

under IAS 18

Revenue

.

Adoption of AASB 15 is only

mandatory for the year ending

30 June 2019.

Due to the recent release of this

standard, the entity has not yet

made a detailed assessment of

the impact of this standard.

Mandatory for financial

years commencing on or

after 1 January 2018.

Expected date of

adoption by the Group: 1

July 2018

AASB

2014-9

(issued

December

2014)

Amend-

ments to

Australian

Accounting

Standards -

Equity

Method in

Separate

Financial

Statements

Currently,

investments

in

subsidiaries, associates and joint

ventures are accounted for in

separate financial statements at

cost or at fair value under AASB

139/AASB 9. These amendments

provide an additional option to

account for these investments

using the equity method as

described in AASB 128

Investments in Associates and Joint

Ventures

.

It is not anticipated that the

changes will have any material

impact on the Group's financial

statements.

Mandatory for financial

years commencing on or

after 1 January 2016.

Expected date of

adoption by the Group: 1

July 2016

AASB

2014-4

(issued

August

2014)

Amendments

to Australian

Accounting

Standards -

Clarification

of

Acceptable

Methods of

Depreciation

and

Amortisation

Clarifies that use of revenue-based

methods

for

calculating

depreciation and amortisation is not

appropriate because revenue

generated by an activity that

includes the use of an asset

generally reflects factors other than

the consumption of economic

benefits embodied in the asset.

This assumption is rebuttable for

intangible assets and can be

overcome in limited circumstances,

for example, where revenue is

established as the predominant

limiting factor in the contract, such

as a concession to explore and

extract from a gold mine that

expires when total

cumulative

revenue from extraction of gold

reaches a certain dollar threshold.

The Standard will not have an

impact on the Group's financial

statements as it does not use

any revenue-based methods for

calculating depreciation and

amortisation.

Mandatory for financial

years commencing on or

after 1 January 2016.

Expected date of

adoption by the Group: 1

July 2016

Independence Group NL

46