NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

Annual Report 2015 111

Notes to the consolidated financial statements

30 June 2015

2 Summary of significant accounting policies (continued)

(af) New standards and interpretations not yet adopted (continued)

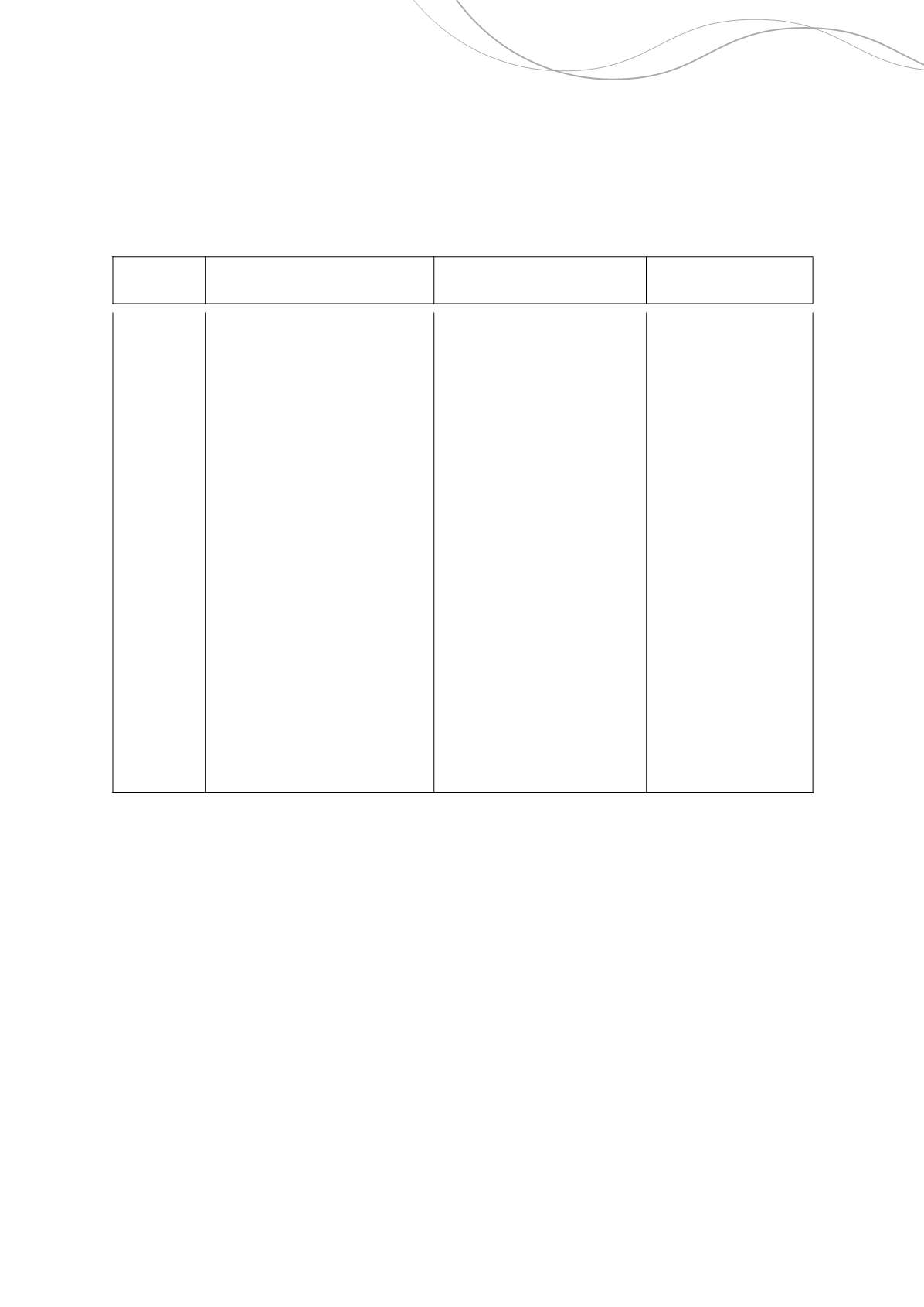

Title of

standard Nature of change

Impact

Mandatory application

date/ Date of adoption

by group

AASB

2014-3

(issued

August

2014)

Amendments

to Australian

Accounting

Standards -

Accounting

for

Acquisitions

of Interests

in Joint

Ventures

When an entity acquires an interest

in a joint operation whose activities

meet the definition of a ‘business’ in

AASB 3

Business Combinations

, to

the extent of its share of assets,

liabilities, revenues and expenses

as specified in the contractual

arrangement, the entity must apply

all of the principles for business

combination accounting in AASB 3,

and other IFRSs, to the extent that

they do not conflict with AASB 11

Joint

Arrangements

.This means

that

it

will

expense all

acquisition-related costs and

recognise its share, according to

the contractual arrangements, of:

• Fair value of identifiable assets

and liabilities, unless fair value

exceptions included in AASB 3 or

other IFRSs, and

• Deferred tax assets and liabilities

that arise from the initial recognition

of an asset or liability as required

by AASB 3 and AASB 112

Income

Taxes

.

Goodwill will then be recognised as

the excess consideration over the

fair value of net identifiable assets

acquired.

There will be no impact on the

financial statements when these

amendments are first adopted

because

they

apply

prospectively to acquisitions of

interests in joint operations.

Mandatory for financial

years commencing on or

after 1 January 2016.

Expected date of

adoption by the Group: 1

July 2016

Independence Group NL

47