NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

124 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

4 Financial risk management (continued)

(d) Recognised fair value measurements (continued)

(iv)

Fair value of other financial instruments

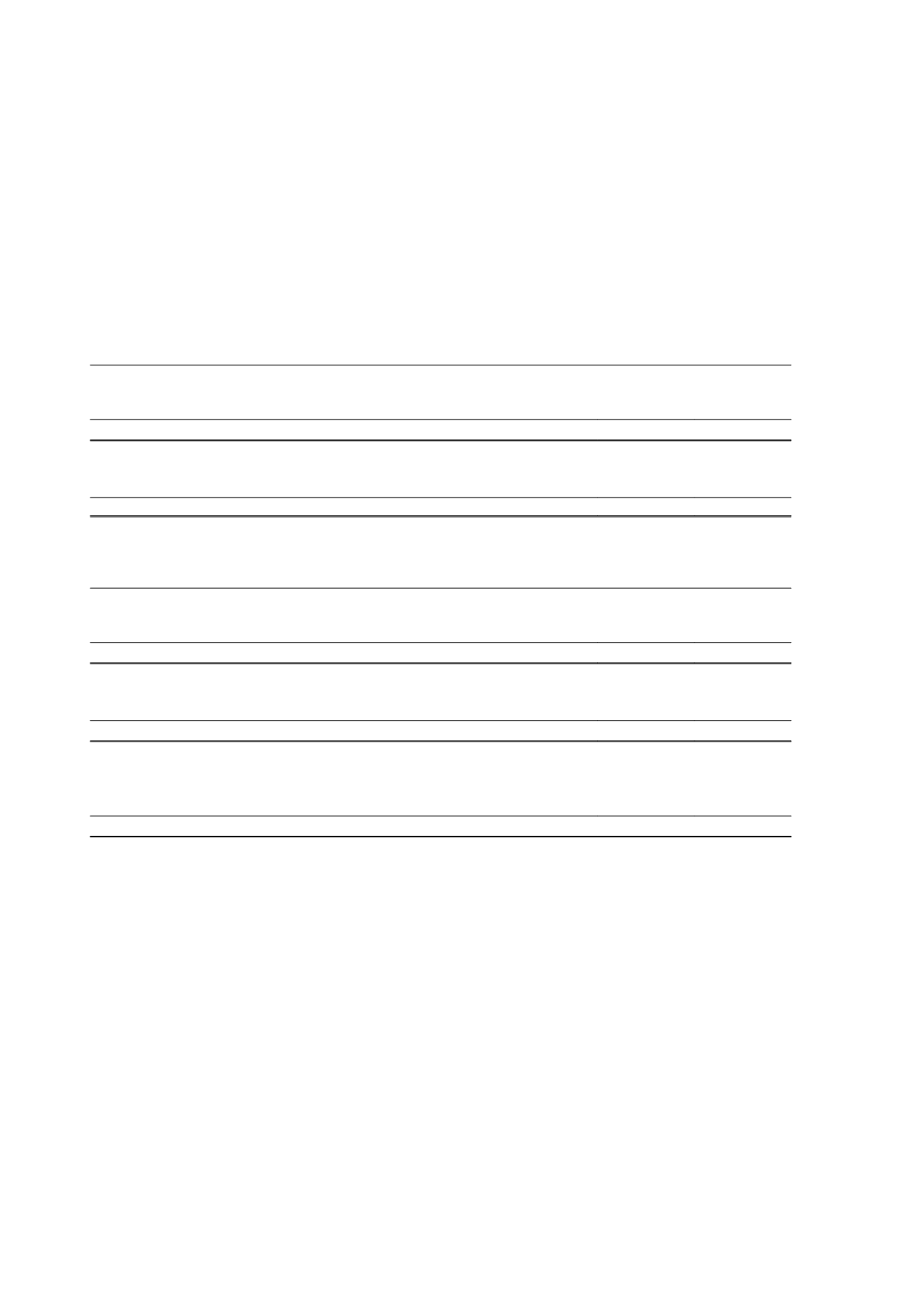

The Group also has a number of financial instruments which are not measured at fair value in the balance sheet. These

instruments had the following fair value at the reporting date.

Carrying

amount

$'000

Fair value

$'000

At 30 June 2015

Current assets

Cash and cash equivalents

121,296

121,296

121,296

121,296

Current liabilities

Lease liabilities

510

522

510

522

Carrying

amount

$'000

Fair value

$'000

At 30 June 2014

Current assets

Cash and cash equivalents

56,972

56,972

56,972

56,972

Current liabilities

Lease liabilities

3,508

3,671

3,508

3,671

Non-current liabilities

Bank loans

24,344

25,000

Lease liabilities

510

522

24,854

25,522

5 Critical accounting estimates and judgements

Estimates and judgements are continually evaluated and are based on historical experience and other factors, including

expectations of future events that may have a financial impact on the entity and that are believed to be reasonable

under the circumstances.

Critical accounting estimates and assumptions

The Group makes estimates and assumptions concerning the future. The resulting accounting estimates will, by

definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk of causing

a material adjustment to the carrying amounts of assets and liabilities within the next financial year are discussed below.

(i)

Trade receivables

The Group estimates the value of trade receivables in accordance with the accounting policy disclosed in note 2(j).

Independence Group NL

60