NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

Annual Report 2015 119

Notes to the consolidated financial statements

30 June 2015

4 Financial risk management (continued)

(a) Risk exposures and responses (continued)

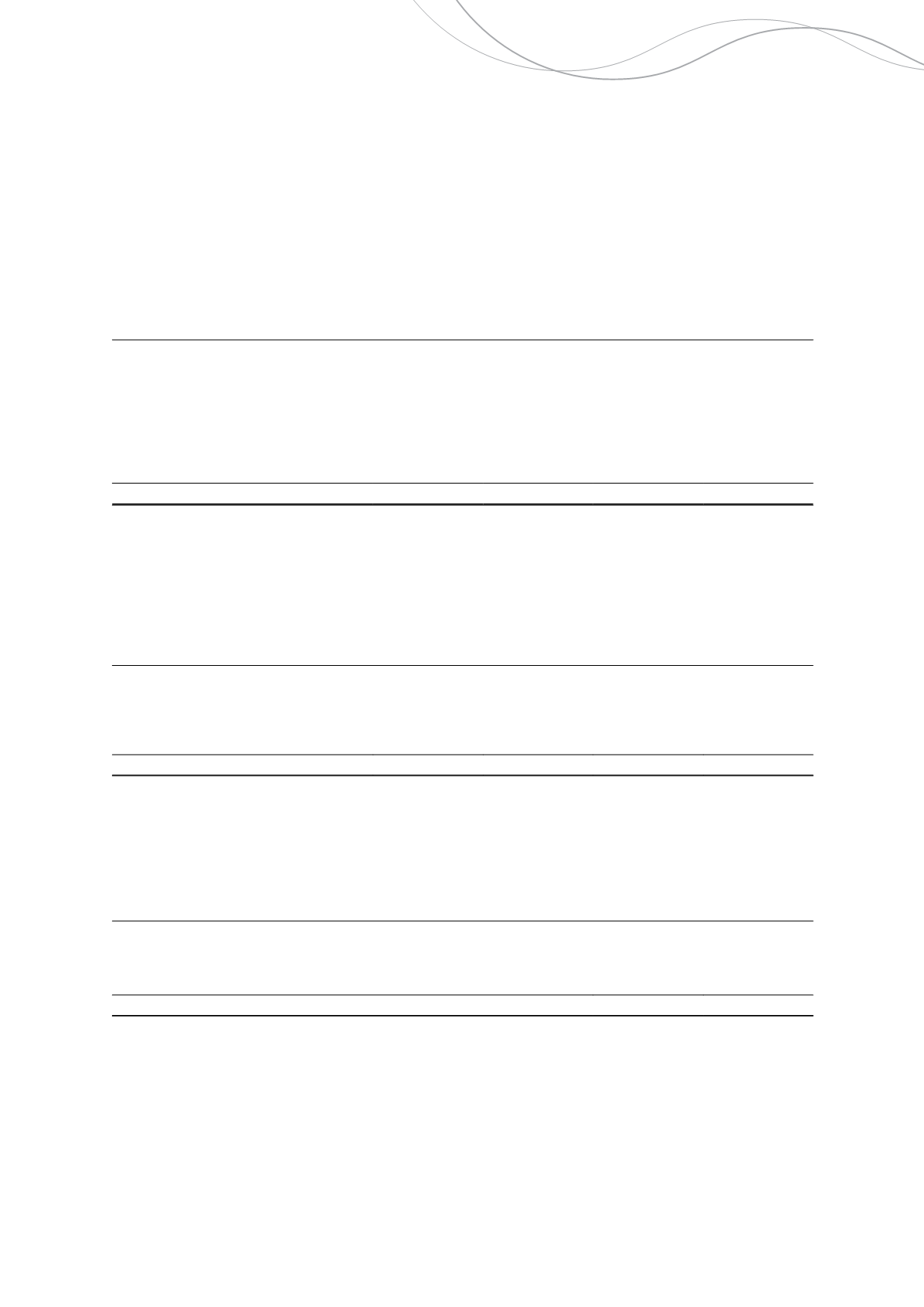

Impact on post-tax profit

Impact on other components of

equity

Sensitivity of financial instruments to

copper price movements

2015

$'000

2014

$'000

2015

$'000

2014

$'000

Financial assets

Trade receivables

Increase 1.5% (2014: 1.5%)

6

11

-

-

Decrease 1.5% (2014: 1.5%)

(6)

(11)

-

-

Derivative financial instruments - commodity

hedging contracts

Increase 20.0% (2014: 20.0%)

(578)

(960)

-

(1,323)

Decrease 20.0% (2014: 20.0%)

578

957

-

1,317

Net sensitivity to copper price movements

-

(3)

-

(6)

The following table summarises the sensitivity of financial instruments held at 30 June 2015 to movements in the gold

price, with all other variables held constant. A 20.0% (2014: 20.0%) sensitivity rate is used to value derivative contracts

held and is based on reasonable assessment of the possible changes.

Impact on post-tax profit

Impact on other components of

equity

Sensitivity of financial instruments to

gold price movements

2015

$'000

2014

$'000

2015

$'000

2014

$'000

Financial assets

Derivative financial instruments - commodity

hedging contracts

Increase 20.0% (2014: 20.0%)

(432)

(4,280)

(6,158)

-

Decrease 20.0% (2014: 20.0%)

959

1,581

4,366

-

Net sensitivity to gold price movements

527

(2,699)

(1,792)

-

The following table summarises the sensitivity of financial instruments held at 30 June 2015 to movements in the zinc

price, with all other variables held constant. Trade receivables valuation uses a sensitivity analysis of 1.5% (2014: 1.5%)

which is based upon the three month forward commodity rate as there is a generally a four month lag time between

delivery and final zinc price received.

Impact on post-tax profit

Sensitivity of financial instruments to zinc price movements

2015

$'000

2014

$'000

Financial assets

Trade receivables

Increase 1.5% (2014: 0%)

108

-

Decrease 1.5% (2014: 0%)

(108)

-

Net sensitivity to zinc price movements

-

-

(iii)

Equity price risk sensitivity analysis

The following sensitivity analysis has been determined based on the exposure to equity price risks at the reporting date.

Each equity instrument is assessed on its individual price movements with the sensitivity rate based on a reasonably

possible change of 45% (2014: 45%). At reporting date, if the equity prices had been higher or lower, net profit for the

year would have increased or decreased by $4,890,000 (2014: $254,000).

Independence Group NL

55