NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

122 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

4 Financial risk management (continued)

(c) Liquidity risk (continued)

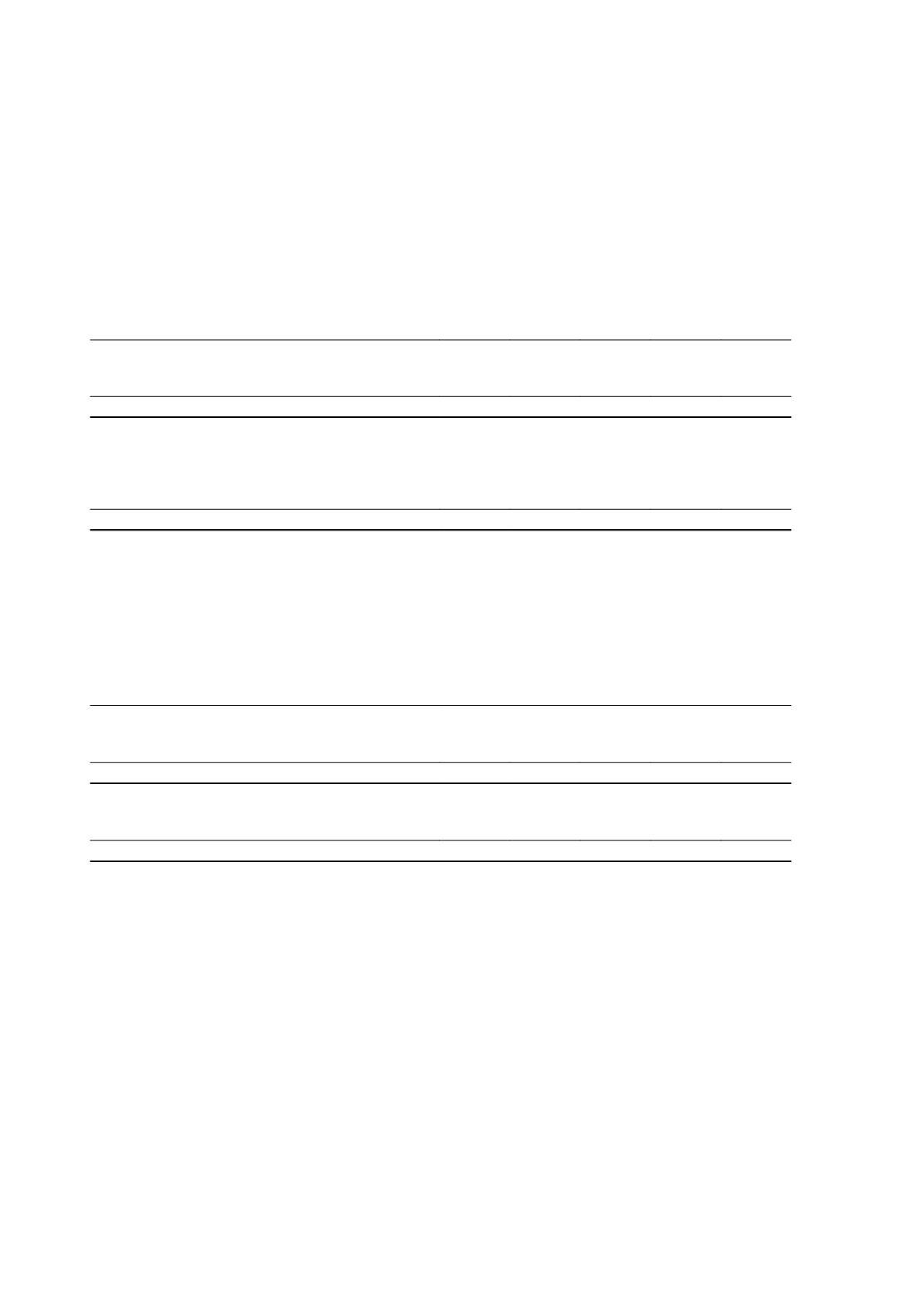

Contractual maturities of financial liabilities

Less than

6 months

6 - 12

months

Between

1 and 5

years

Total

contractual

cash

flows

Carrying

amount

$'000

$'000

$'000

$'000

$'000

At 30 June 2015

Trade and other payables

40,476

-

-

40,476 40,476

Finance lease liabilities

458

64

-

522

510

40,934

64

-

40,998 40,986

At 30 June 2014

Trade and other payables

42,982

-

-

42,982 42,982

Finance lease liabilities

2,300

1,371

522

4,193

4,018

Bank loans

-

-

25,000 25,000 24,344

45,282

1,371 25,522 72,175 71,344

The following table details the Group’s liquidity analysis for its derivative financial instruments. The table is based on the

undiscounted net cash inflows/(outflows) on the derivative instrument that settles on a net basis. When the net amount

payable is not fixed, the amount disclosed has been determined by reference to the projected forward curves existing at

the reporting date.

Less than

6 months

6 - 12

months

Between

1 and 5

years

Total

contractual

cash

flows

Carrying

amount

$'000

$'000

$'000

$'000

$'000

At 30 June 2015

Commodity hedging contracts

100

662

717

1,479

1,479

Foreign currency hedging contracts

1,622

-

-

1,622

1,622

1,722

662

717

3,101

3,101

At 30 June 2014

Commodity hedging contracts

3,013

3,368

-

6,381

6,381

3,013

3,368

-

6,381

6,381

(d) Recognised fair value measurements

(i)

Fair value hierarchy

The fair value of financial assets and liabilities must be estimated for recognition and measurement or for disclosure

purposes.

AASB 13

Fair Value Measurement

requires disclosure of fair value measurements by level of the following fair value

measurement hierarchy:

(a) quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1);

(b) inputs other than quoted prices included within level 1 that are observable for the asset or liability, either

directly (as prices) or indirectly (derived from prices) (level 2); and

(c) inputs for the asset or liability that are not based on observable market data (unobservable inputs) (level 3).

The following table presents the Group’s assets and liabilities measured and recognised at fair value at 30 June 2015

and 30 June 2014 on a recurring basis.

Independence Group NL

58