NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

Annual Report 2015 123

Notes to the consolidated financial statements

30 June 2015

4 Financial risk management (continued)

(d) Recognised fair value measurements (continued)

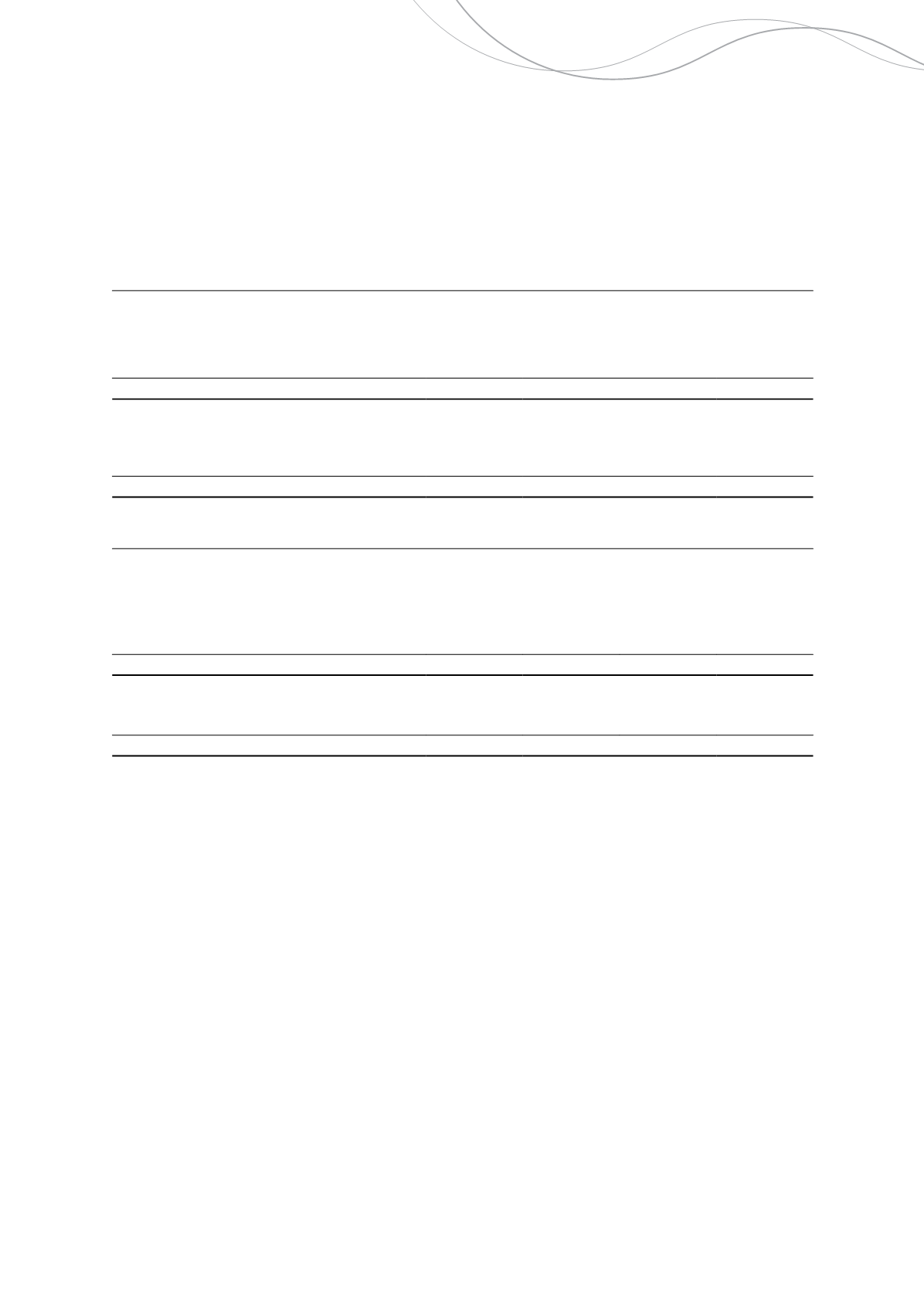

Level 1

$'000

Level 2

$'000

Level 3

$'000

Total

$'000

At 30 June 2015

Financial assets

Listed and unlisted investments

15,524

-

50

15,574

Derivative instruments

Commodity hedging contracts

-

4,981

-

4,981

15,524

4,981

50

20,555

Financial liabilities

Derivative instruments

Commodity hedging contracts

-

1,479

-

1,479

Foreign currency hedging contracts

-

1,622

-

1,622

-

3,101

-

3,101

Level 1

$'000

Level 2

$'000

Level 3

$'000

Total

$'000

At 30 June 2014

Financial assets

Listed and unlisted investments

808

-

50

858

Derivative instruments

Foreign currency hedging contracts

-

1,400

-

1,400

Commodity hedging contracts

-

1,777

-

1,777

808

3,177

50

4,035

Financial liabilities

Derivative instruments

Commodity hedging contracts

-

6,381

-

6,381

-

6,381

-

6,381

The Group did not measure any financial assets or financial liabilities at fair value on a non-recurring basis as at 30

June 2015 and did not transfer any fair value amounts between the fair value hierarchy levels during the year ended 30

June 2015.

(ii)

Valuation techniques used to determine level 1 fair values

The fair value of financial instruments traded in active markets (such as publicly traded derivatives and trading and

available-for-sale securities) is based on quoted market prices at the end of the reporting period. The quoted market

price used for financial assets held by the Group is the current bid price. These instruments are included in level 1.

(iii)

Valuation techniques used to determine level 2 and level 3 fair values

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives)

is determined using valuation techniques. These valuation techniques maximise the use of observable market data

where it is available and rely as little as possible on entity specific estimates. If all significant inputs required to fair value

an instrument are observable, the instrument is included in level 2.

If one or more of the significant inputs is not based on observable market data, the instrument is included in level 3.

Specific valuation techniques used to value financial instruments include:

• The use of quoted market prices or dealer quotes for similar instruments.

• The fair value of commodity and forward foreign exchange contracts is determined using forward commodity and

exchange rates at the reporting date.

• Other techniques, such as discounted cash flow analysis, are used to determine fair value for the remaining

financial instruments.

All of the resulting fair value estimates are included in level 2 except for unlisted equity securities which are included in

level 3.

Independence Group NL

59