NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

120 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

4 Financial risk management (continued)

(a) Risk exposures and responses (continued)

(iv)

Cash flow and fair value interest rate risk

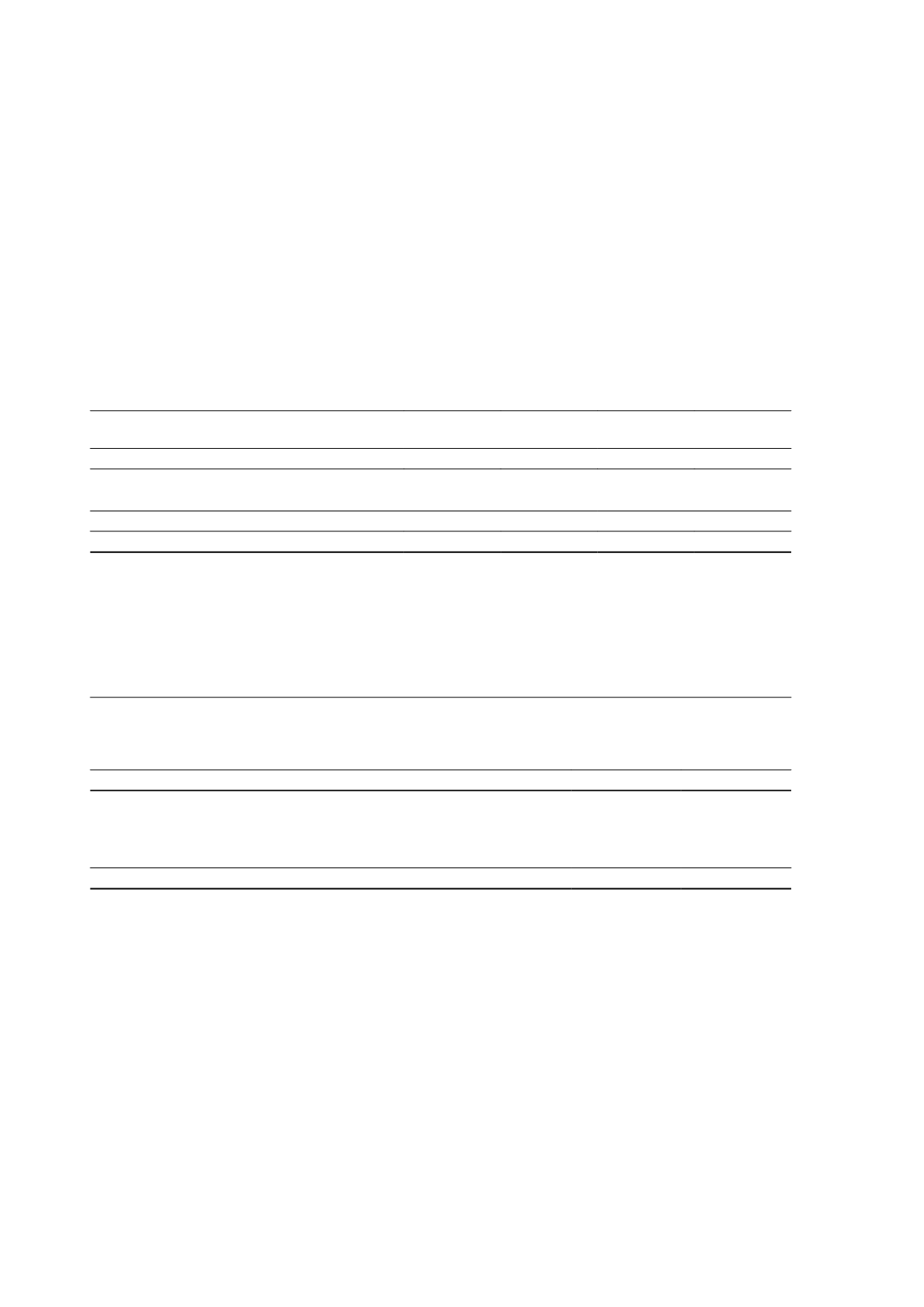

The Group’s exposure to interest rate risk is the risk that a financial instrument’s value will fluctuate as a result of

changes in market interest rates. At the reporting date, the Group had the following exposure to interest rate risk on

financial instruments:

30 June 2015

30 June 2014

Weighted

average

interest rate

%

Balance

$'000

Weighted

average

interest rate

%

Balance

$'000

Financial assets

Cash and cash equivalents

1.6% 121,296

1.3% 56,972

1.6% 121,296

1.3% 56,972

Financial liabilities

Bank loans

-

-

4.9% 25,000

-

-

4.9% 25,000

Net exposure

1.6%

121,296

(3.6)%

31,972

The sensitivity analysis below has been determined based on the exposure to interest rates at the reporting date and

the stipulated change taking place at the beginning of the financial year and held constant throughout the reporting

period. A 100 basis point increase or decrease is used when reporting interest rate risk internally to key management

personnel and represents management’s assessment of the possible change in interest rates.

Impact on post-tax profit

Sensitivity of interest revenue and expense to interest rate movements

2015

$'000

2014

$'000

Revenue

Interest revenue

Increase 1.0% (2014: 1.0%)

293

243

Decrease 1.0% (2014: 1.0%)

(293)

(243)

-

-

Expense

Interest expense

Increase 0% (2014: 1.0%)

-

(175)

Decrease 0% (2014: 1.0%)

-

175

-

-

The interest rate on the outstanding lease liabilities is fixed for the term of the lease, therefore there is no exposure to

movements in interest rates.

(b) Credit risk

Nickel ore sales

The Group has a concentration of credit risk in that it depends on BHP Billiton Nickel West Pty Ltd for a significant

volume of revenue. During the year ended 30 June 2015 all nickel sales revenue was sourced from this company. The

risk is mitigated in that the agreement relating to sales revenue contains provision for the Group to seek alternative

revenue providers in the event that BHP Billiton Nickel West Pty Ltd is unable to accept supply of the Group’s product

due to a force majeure event. The risk is further mitigated by the receipt of 70% of the value of any months’ sale within a

month of that sale occurring.

Independence Group NL

56