Annual Report 2015 31

FY2015 GOLD PRODUCTION AND CASH COSTS

WERE BETTER

THAN ORIGINAL GUIDANCE AND THE MINE DELIVERED

CONSISTENT PERFORMANCE ACROSS MOST METRICS OVER

ALL QUARTERS.

FY2015 Production

During FY2015 the TGM mined a total of 23M bank cubic metres (BCM) which was in line with the budget of 23.6M BCM. Of this

material there were 12.4Mt of ore (10.8Mt of Full Ore (>0.6g/t) and 1.6Mt of Marginal Ore (>0.4g/t to <0.6g/t)) and 46Mt of waste

mined.

Ore was sourced from the Havana pit (6.8Mt) and the Tropicana pit (5.6Mt). Average grades for the full ore mined was 2.06g/t

Au over this period. Pre-strip mining in the Boston Shaker open pit commenced late in the June 2015 quarter.

The processing plant achieved a throughput of 5.83Mt at an average feed grade of 2.92g/t. Gold recoveries were as expected

at 90.2% for recovered gold of 496,004oz. The focus is now on system improvements to access efficiency opportunities in an

attempt to push mill throughput beyond nameplate capacity.

IGO is pleased to report that its attributable gold production for FY2015 was 148,923oz with 150,836oz of gold sold. Average cash

costs in FY2015 were $568/oz Au produced.

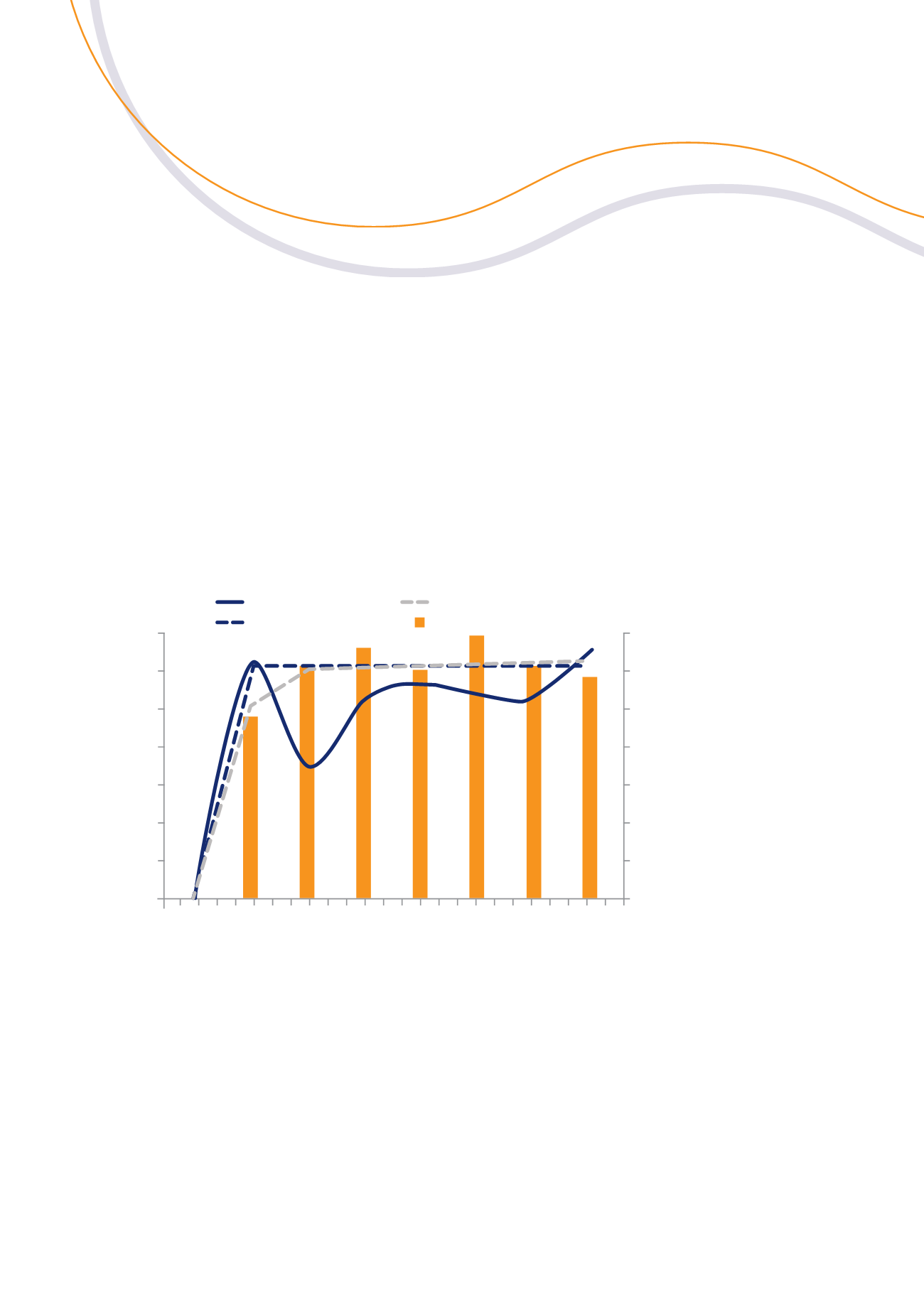

Gold production (koz)

Cash costs ($/oz Au)

Cash costs ($/oz)

Production guidance

Cash costs guidance

Sep 13 Dec 13 Mar 14 Jun 14 Sep 14 Dec 14 Mar 15 Jun 15

140

120

100

80

60

40

20

-

$700

$600

$500

$400

$300

$200

$100

$0

Figure 5: Tropicana production and cost performance over the previous two years

Gold produced

FY2016 Guidance and Initial Grade Streaming Strategy

The initial grade streaming strategy at Tropicana, which the joint venture partners adopted to deliver early project returns,

is expected to come to an end during the second half of FY2016 (H2 FY2016). The grade streaming strategy has involved an

accelerated mining profile and associated stockpiling strategy. This has resulted in more ore being mined than required for

the processing plant, thereby allowing the higher grade portion to be processed and the progressive build-up of a low grade

stockpile.

As a result of the cessation of grade streaming, gold production in H2 FY2016 will be lower and costs higher, resulting in full year

gold production for FY2016 at Tropicana of 430,000 to 470,000oz (100% basis) at a cash cost of $640 to $710/oz Au produced.

IGO expects its attributable gold production during FY2016 to be in the range of 129,000 to 141,000oz with cash costs plus

royalties being in the range of $640 to $710/oz Au. IGO’s share of exploration expenditure is expected to be approximately $9 –

$11 million and IGO’s share of sustaining capital is expected to be approximately $8 – $10 million.

From H2 FY2016, the average grade processed at Tropicana is expected to be at the average reserve grade of about ~2 g/t Au,

which will be maintained over the next few years.