NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

Annual Report 2015 117

Notes to the consolidated financial statements

30 June 2015

4 Financial risk management (continued)

(a) Risk exposures and responses (continued)

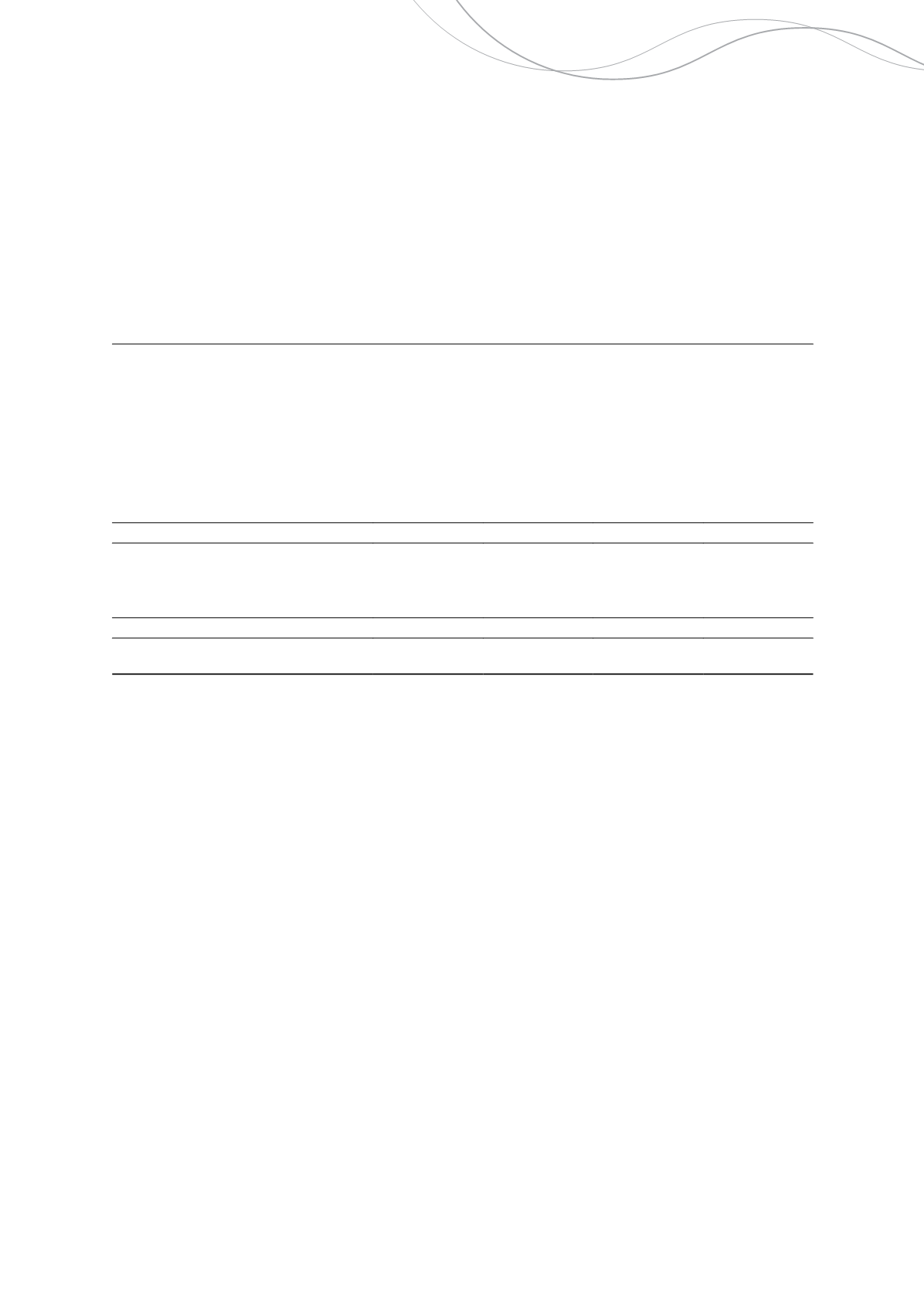

Impact on post-tax profit

Impact on other components of

equity

Sensitivity of financial instruments to

foreign currency movements

2015

$'000

2014

$'000

2015

$'000

2014

$'000

Financial assets

Cash and cash equivalents

Increase 18.0% (2014: 3.0%)

(1,812)

(365)

-

-

Decrease 18.0% (2014: 3.0%)

2,608

388

-

-

Trade receivables

Increase 1.5% (2014: 1.5%)

(120)

(176)

-

-

Decrease 1.5% (2014: 1.5%)

140

222

-

-

Derivative financial instruments

Increase 5.0% (2014: 5.0%)

(166)

361

-

1,444

Decrease 5.0% (2014: 5.0%)

183

(399)

-

(1,596)

833

31

-

(152)

Financial liabilities

Derivative financial instruments

Increase 5.0% (2014: 5.0%)

693

50

-

163

Decrease 5.0% (2014: 5.0%)

(766)

(55)

-

(180)

(73)

(5)

-

(17)

Net sensitivity to foreign currency

movements

760

26

-

(169)

(ii)

Commodity price risk

The Group’s sales revenues are generated from the sale of nickel, copper, zinc, silver and gold. Accordingly, the

Group’s revenues, derivatives and trade receivables are exposed to commodity price risk fluctuations, primarily nickel,

copper, zinc, silver and gold.

Nickel

Nickel ore sales have an average price finalisation period of three months until the sale is finalised with the customer.

It is the Board’s policy to hedge between 0% and 50% of total nickel production tonnes. All of the hedges qualify as

“highly probable” forecast transactions for hedge accounting purposes.

Copper and zinc

Copper and zinc concentrate sales have an average price finalisation period of up to four months from shipment date.

It is the Board’s policy to hedge between 0% and 50% of total copper and zinc production tonnes.

Gold

It is the Board’s policy to hedge between 0% and 50% of forecast gold production from the Company’s 30% interest in

the Tropicana Gold Mine.

The markets for nickel, copper, zinc, silver and gold are freely traded and can be volatile. As a relatively small producer,

the Group has no ability to influence commodity prices. The Group mitigates this risk through derivative instruments,

including, but not limited to, quotational period pricing, forward contracts and collar arrangements.

At the reporting date, the carrying value of the financial instruments exposed to commodity price movements were as

follows:

Independence Group NL

53