NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015

118 Independence Group NL

Notes to the consolidated financial statements

30 June 2015

4 Financial risk management (continued)

(a) Risk exposures and responses (continued)

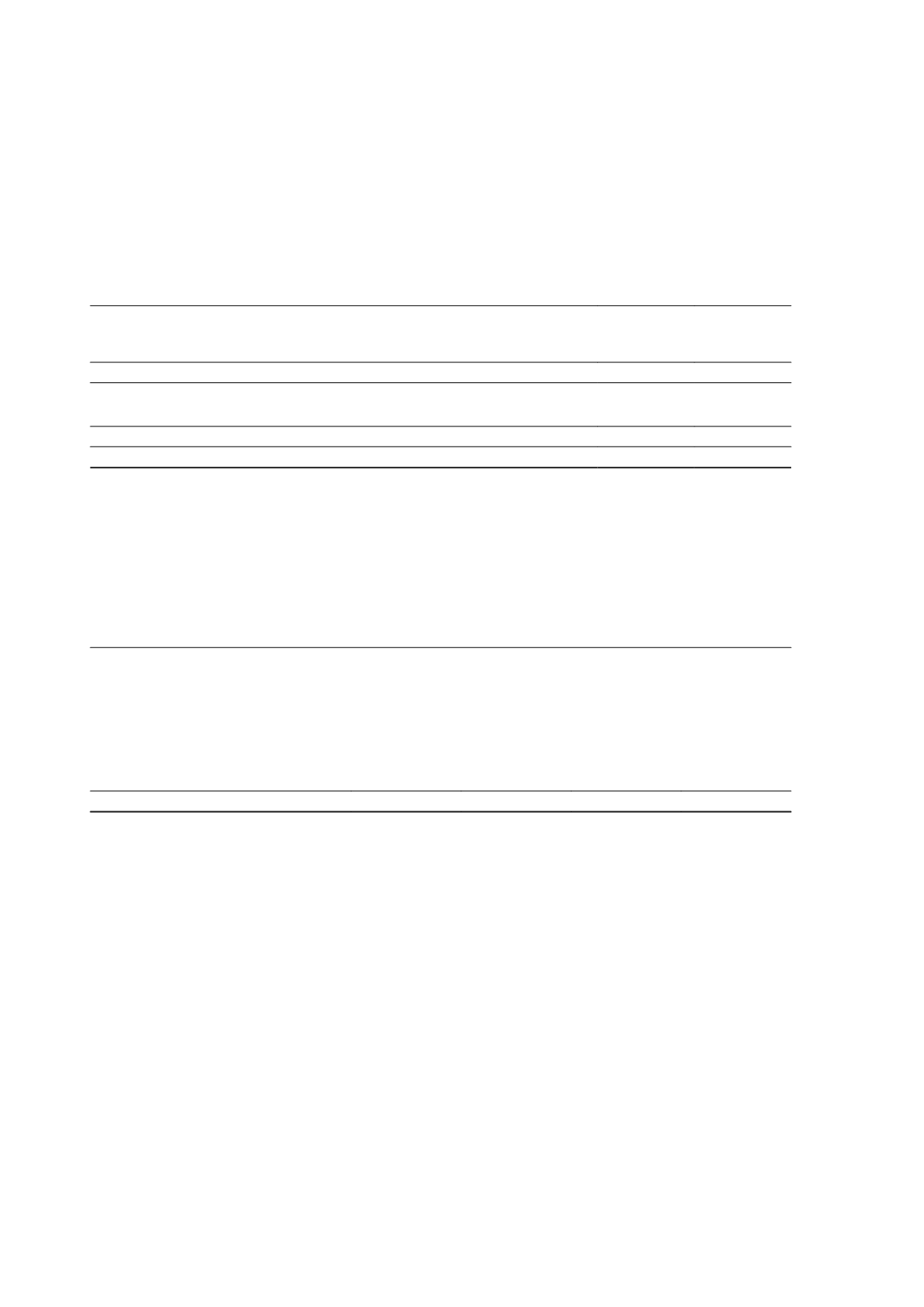

Financial instruments exposed to commodity price movements

2015

$'000

2014

$'000

Financial assets

Trade and other receivables

10,702

19,853

Derivative financial instruments - commodity hedging contracts

4,981

1,777

15,683

21,630

Financial liabilities

Derivative financial instruments - commodity hedging contracts

1,479

6,381

1,479

6,381

Net exposure

14,204

15,249

The following table summarises the sensitivity of financial instruments held at 30 June 2015 to movements in the nickel

price, with all other variables held constant. Trade receivables valuation uses a sensitivity analysis of 1.5% (2014: 1.5%)

which is based upon the three month forward commodity rate as there is a three month lag time between delivery and

final nickel price received. A 20.0% (2014: 20.0%) sensitivity rate is used to value derivative contracts held and is based

on reasonable assessment of the possible changes.

Impact on post-tax profit

Impact on other components of

equity

Sensitivity of financial instruments to

nickel price movements

2015

$'000

2014

$'000

2015

$'000

2014

$'000

Financial assets

Trade receivables

Increase 1.5% (2014: 1.5%)

117

217

-

-

Decrease 1.5% (2014: 1.5%)

(117)

(217)

-

-

Derivative financial instruments - commodity

hedging contracts

Increase 20.0% (2014: 20.0%)

(1,634)

(1,346)

-

(3,949)

Decrease 20.0% (2014: 20.0%)

1,634

1,353

-

3,946

Net sensitivity to nickel price movements

-

7

-

(3)

The following table summarises the sensitivity of financial instruments held at 30 June 2015 to movements in the copper

price, with all other variables held constant. Trade receivables valuation uses a sensitivity analysis of 1.5% (2014: 1.5%)

which is based upon the three month forward commodity rate as there is generally a four month lag time between

delivery and final copper price received. A 20.0% (2014: 20.0%) sensitivity rate is used to value derivative contracts

held and is based on reasonable assessment of the possible changes.

Independence Group NL

54